MONTHLY NEWSLETTER – SEPTEMBER 2024

A summary of key events and market trends during the month of September

Global Markets Updates

Barring Japan most global equity markets etched out gains for the month as investors returned after the summer break.

China again the outlier and this month from a positive perspective with the China Enterprises Index up around 18 % for the month and now up 30 % from the start of the year.

Japan’s Topix was down around 2% for the month with investors digesting the interest rate hiking schedule from the Bank of Japan and now the prospects of elections at the end of October.

We look forward to a new round of earnings releases, the key which will be from the large US banks. Any pessimistic outlooks or large loss provisions will sour the mood as investors will start to position for a bleak economic reality and the calls for a recession grow.

The US interest rates markets now expect the Federal Funds overnight rate to be at around 3 % by the end of 2025. We see the US economy as still relatively strong, all things considered and expect the US elections to be an inflection point for policy, based on the outcome.

Similar rate expectations for Europe stand at 1.75 % and indicative of the slower growth and the shifting political profile on the Continent.

The US elections are now a month away and we expect overall flows and participation to be muted on account of that. Most participants will want to see the outcome to assess the direction of policy and then adjust their exposures accordingly.

The Volatility Index has now settled below the pivot level of 20 and we expect this to move around a bit as we head into the US elections.

CONSOLIDATION WITH AN UPWARD BIAS…

The Dax, S&P 500 and Dow Jones Industrial Index managed to make fresh all-time highs this month but not significantly higher

Key Markets

- Trading volumes in September have continued to be light and most price action has been somewhat sideways as investors return from the summer holidays.

- China on the other hand managed to buck this listless trend with a strong showing and the Hang Seng China Enterprises Index up around 18 % for the month and greater than 30 % for 2024.

- Driving this strong move in asset prices as a slew of support measures across the most critical segments of the economy.

- These include monetary policy, real estate and a focus on the equity markets too. Importantly the measures announced have come across major regulatory organizations including the Peoples Bank of China, the China Securities Regulatory Commission and the National Financial Regulatory Administration amongst others.

- The point of highlighting the broad coordination is to underline the point that this is likely to have been orchestrated at the highest levels of the government – a good sign as far as looking at the durability of the policy initiatives.

- The key sector to monitor going forward is the housing sector and market as this is an area that households have had to absorb a considerable amount of pain over the last few years.

- The housing markets have been significantly and negatively impacted with many building and real estate companies in distress with defaults on financial obligations as well as on construction projects.

- The sums of money being provided as support, almost a trillion Renminbi (USD 150 billion) are large by any standards and equally encouraging they appear to be open-ended rather than close-ended in tenor.

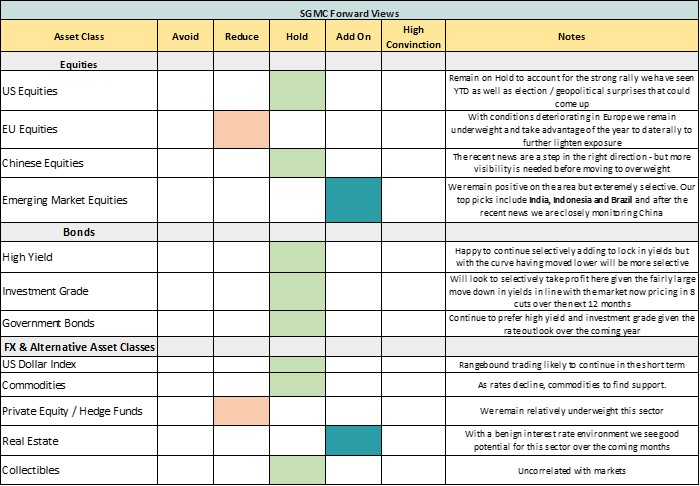

SGMC Forward Views …

- No changes to current allocations