MONTHLY NEWSLETTER – FEBRUARY 2024

March 1, 2024 |

Download Document

A summary of key events and market trends during the month of February

Global Markets Updates

- US Rates markets are where we have thought they should be since the start of the year. The expectation of 6 cuts was excessive and the market now pricing in around 3 is closer in line with our views

- GDP growth in the US continues to be strong and the employment numbers have been holding steady too. Corporate earnings have been generally good with this earnings season showing around a 7 % positive earnings surprise compared to expectations

- While headline job cut data still grabbing attention we expect the economy to cool somewhat in the coming months which allows the Federal Reserve to ease heading into the end of the year

- Investors who have been waiting on the sidelines and missed out on last year’s rally will not have the luxury of sitting out another year of strong performance. And we believe that the incremental allocations into equity could be meaningful

- Artificial Intelligence has captured the attention of investors. Many companies are being able to drive performance outcomes both at top-line and bottom-line levels. The productivity gains realized from the deployment of AI related technologies will be out-sized and hence rising nominal asset prices are not always leading to pricier valuations

- Many comparisons of the expected AI Boom to the Internet Boom will be made. And we believe this is the right facsimile. Having said that, we also believe that the true nature of the AI revolution will only be understood down the road. Right now there is a lot of excitement. The heavy work and maturation of the technology cycle will lead to even bigger disruptions, and hence opportunities for investors

- The Volatility Index (VIX) continues to hug the lower of the ranges of the last twelve months and barring any untoward geopolitical developments expect it to stay sub-20 for the coming months

Melt Up around the corner ?

We have been expecting equity flows into Artificial Intelligence, and Technology in general, to keep asset markets well supported. Momentum now appears to be picking up.

Key Markets

- Japan’s Nikkei, this month, traded over its historic highs for the first time since 1989. A good part of the support for this market continues to be sourced from the Bank of Japan’s bond buying operations (through the indirect channel of suppressing interest rates). While we cautiously evaluate the BoJ’s monetary policy on-going communications we also note that they will likely move slowly while making the shift to tighter policy.

- China continues with it’s volatile back and forth and we now regard China as a tactical long, given the continuing under-valuation of its equity markets.

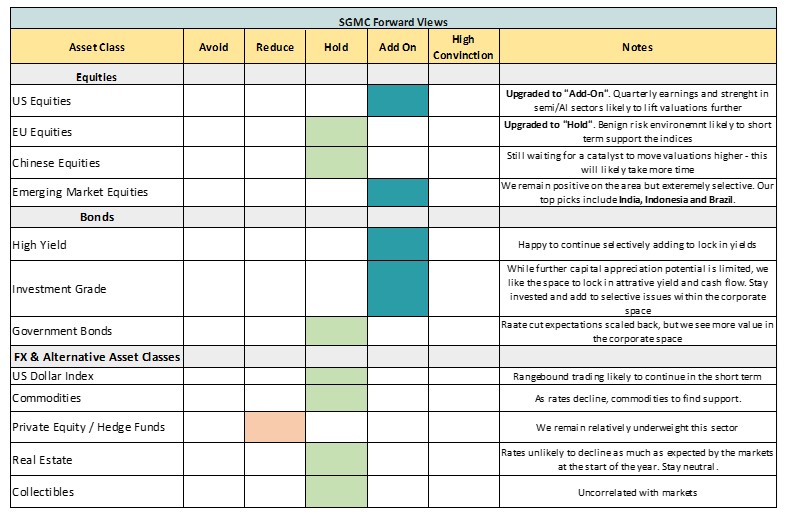

SGMC Forward Views …

- We turned increasingly bullish on the overall equity space (Nasdaq and US in particular) for three main reasons:

- the ease with which equity markets digested revised lower expectations of Fed cuts for 2024 (from 7 in January to the current 3, in line with what we had been saying last year)

- blowout earnings from crucial tech names active within the AI/semiconductor space (Nvidia and Palantir above all)

- GDP growth in the US remains robust and resilient

- In the fixed income space we are happy to selectively add to solid corporate issuers in the low investment grade / BB + credit area to lock in attractive yields and cash flows

- Withing Emerging Markets our preferred geographical focus is Asia, India and Indonesia in particular