MONTHLY NEWSLETTER – APRIL

A summary of key events and market trends during the month of April

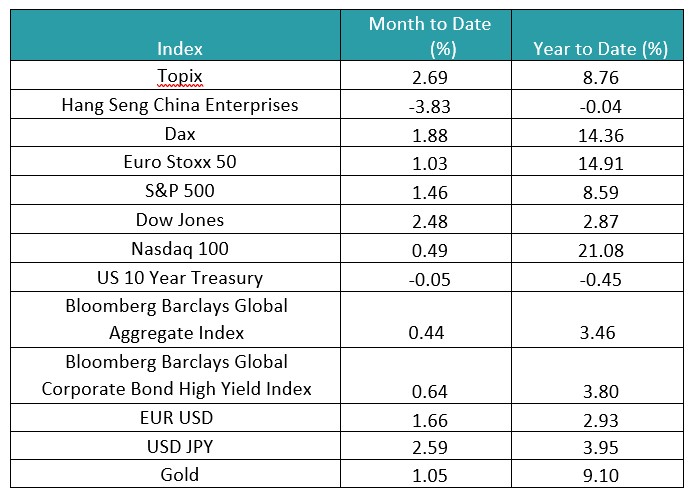

Global Markets Updates

- More than half the S&P 500 companies have reported results with almost all sectors beating sales and earnings expectations, albeit with a low bar.

- In particular, the large cap technology names have fared better than what the bears expected and this has led to some meaningful price rallies. It is worth noting that Apple Inc is yet to report and this announcement is eagerly awaited for this week.

- With the news of First Republic Bank out of the way after the JP Morgan acquisition US regulators will want to see funding and other markets return to normalcy.

- The fallout from the panic that kicked off with Silicon Valley Bank seems contained for now and with US rate unlikely to rise significantly from the current levels we could see some calm pervade.

- This week has the US Federal Reserve and the European Central Bank announce policy rates and markets will be closely watching for the tone that the respective Governors take with regards to future policy.

- Last week the Bank of Japan skewed to the dovish side and this has not surprised us as we see the economy require a weak currency for the moment.

- The Chinese equity markets continue to under-perform this year with investors still seeking clarity on the end of regulatory measures.

- With the Volatility Index trading below 16 we see this as an interesting opportunity to buy cheap protection for portfolios as we run into some event risk with the interest rate meetings.

Last US rate hike for now?

The interest rate markets are pricing in a last rate hike by the US Federal Reserve, a short pause and then rates lower by 50 basis points by the end of the year. With inflation not anywhere close to the 2 % mark we do not see rate cuts coming through in a hurry.

Key Markets

- The market awaits the latest policy direction from the Fed and the ECB – Inflation is yet to come under any semblance of control and economic activity is still holding ground. As such we would expect central banks to be on hold for an extended period of time.

- 2 year US Treasuries are currently at around 4 % and we would expect rates at this part of the curve to head higher in the medium term.

- Central Bank balance sheets are being rolled off and the open question is how and whether the market can absorb the residual supply.

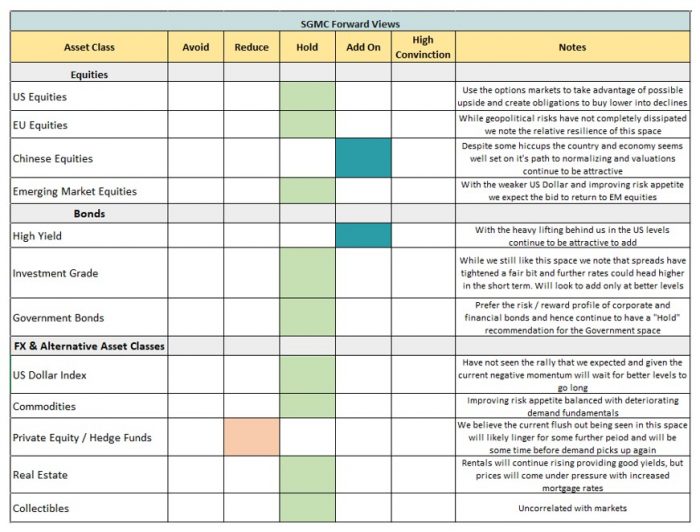

SGMC Forward Views …

- We are currently not making any changes to our forward views and asset allocation. Though, this could change as we assess the tone and content that comes through from the monetary policy meetings over the coming weeks.