MONHLY NEWSLETTER – MARCH 2023

April 1, 2023 |

Download Document

A summary of key events and market trends during the month of March

Global Markets Updates

- Despite high levels of turbulence during the month most equity indices closed higher for the month of March with the Nasdaq 100 Index up around 9 %.

- In the US, liquidity issues starting with deposit outflows from Silicon Valley Bank escalated quickly to ensnare most regional banks and the various US Federal agencies including the Federal Reserve Bank and the Federal Deposit Insurance Corporation were required to take defensive action.

- In Switzerland, Credit Suisse faced deposit outflows as investors chose to quickly move assets out as concerns grew. Despite initial assurances from the Swiss National Bank the bank was finally sold to UBS (pending deal finalization).

- The actions of the Swiss National Bank and its co-regulator, FINMA, towards Additional Tier 1 bondholders, effectively subordinating them to equity owners, then shook confidence across various investor classes.

- We do not appear to have an all-clear as not all issues have yet been addressed; in the US, how many other regional banks will likely need government deposit guarantees; and in Europe, where do funding levels stabilize for subordinated paper.

- We likely see tighter regulations for the banking and allied industries going forward and investors need to understand the knock-on implications of the same on the profitability of various financial institutions.

- A further impact will be on lending activity and is likely to shrink compared to prior period. This has knock-on impacts on growth and inflation which central bankers will factor into their rate setting decisions.

- The 2 year US Treasury bond now trades at just over 4 %; from over 5 % before the banking issues of early March and from around 4.5 % at the start of the year. We see the current levels more as an assessment of risk on / risk off rather than a precise average market assessment of the state of the economy – the recent volatility in the fixed income markets has not been since the Covid crash and before that during the Global Financial Crisis of 2008.

- Companies gear up to report their next batch of quarterly earnings and we will keep a close eye on the earnings releases.

- Despite these various events the Volatility Index has closed towards the lows of the last two years and indicates that investors are not currently looking to hedge exposures.

Banking woes change the calculus?

Bank depositors on both sides of the Atlantic are facing a crisis of confidence – The reaction function of the respective central banks will drive investor outcomes in the immediate term

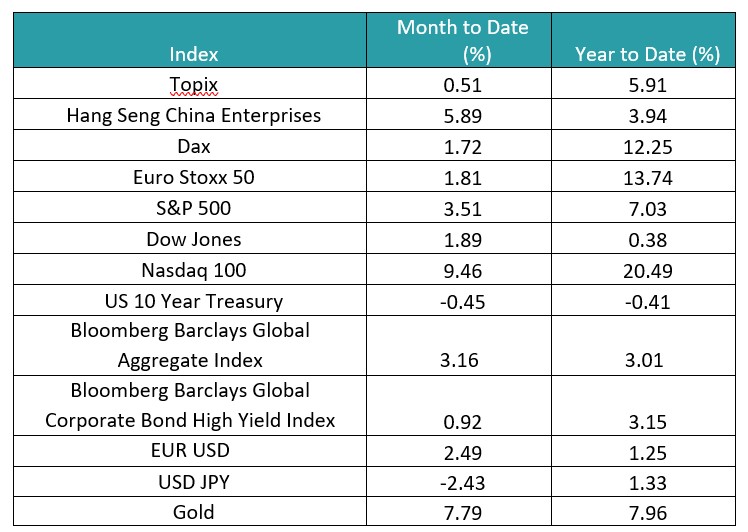

Key Markets

- We await the upcoming Non-Farm Payroll data and to see if the recent banking volatility has already taken a toll on economic activity.

- The technology heavy Nasdaq has attracted renewed investor interest; clean balance sheets, still healthy comparative levels of growth and cash flow generation as well as beaten down valuations provide a safe harbor during the current situation the financial industry finds itself in.

- China is taking the lead on playing dealmaker in the global arena with a particularly high profile deal struck with Saudi Arabia and Iran where the two countries are re-starting diplomatic engagements. This will potentially have an important bearing on global markets and will be followed closely by most observers.

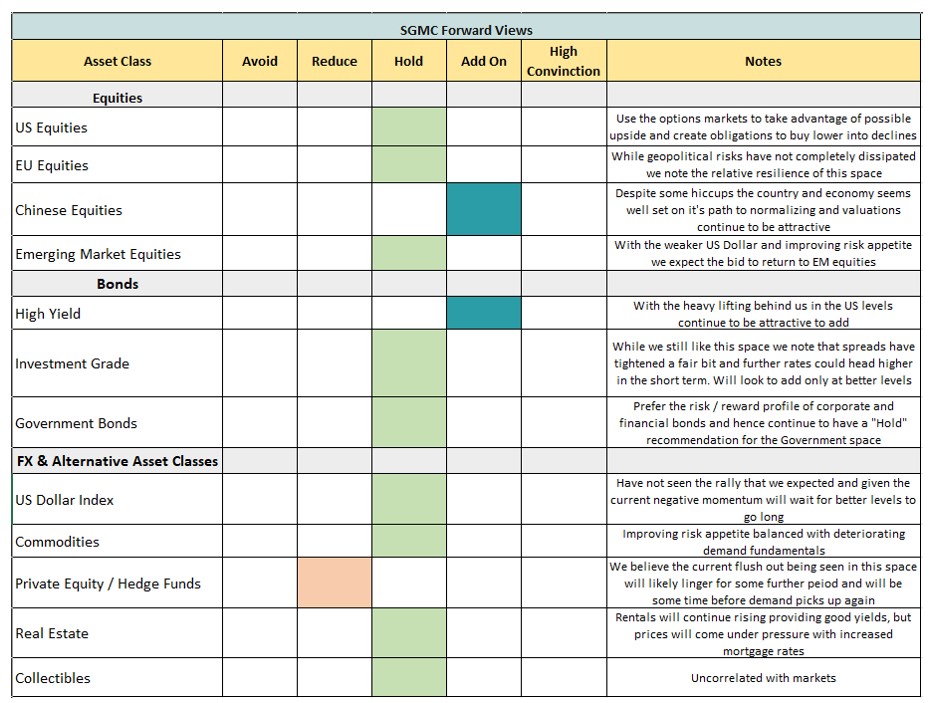

SGMC Forward Views …

- We are currently not making any changes to our forward views and asset allocation. Though, this could change as we assess the tone and content that comes through from the monetary policy meetings over the coming weeks.