January Monthly Review

A summary of key events and market trends during the month of January.

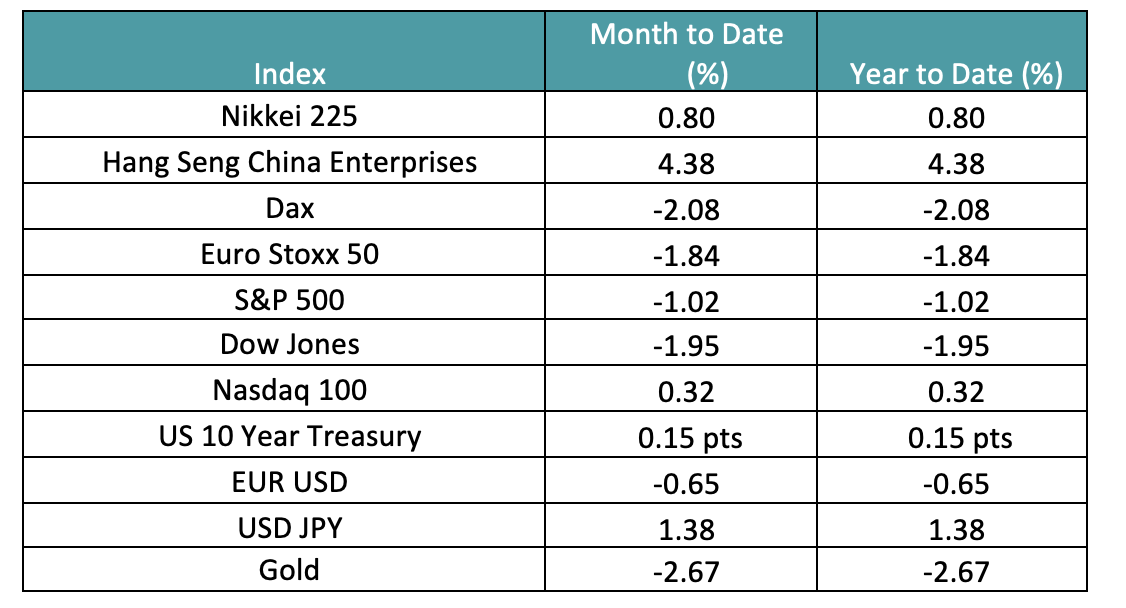

January, for the most part, saw a move higher for the equity markets with Hang Seng China Enterprises Index registering a double-digit gain at the highs, while finally closing up some four percent for the month

The end of the month has seen some volatility induced by trading activity and volatility in stocks like GameStop Corp and AMC Entertainment

Reddit Army on the march?

What appears to be a tail, is likely wagging the dog; we wouldn’t want to amplify recent events more than warranted, however we would also be keeping a close eye on these developments.

Key Markets

A quick recap of 2020 …

Apart from being remembered as the year of the pandemic, 2020 will be remembered as a watershed year where attitudes and technologies changed, and emerged, at warp-speed. It put on display, again, central banks’ desire to not let asset prices decline too much, too fast or in too volatile a manner.

The central bank put is alive and well.

Equity markets recovered from well from the lows of the year and went on to make new all-time highs. The recovery we have seen is being referred to as “K shaped” where some sectors recovered well and others continued to be mired at the lows.

Given the move up in the value of various crypto-currencies a renewed focus has developed around blockchain and other de-centralised technologies.

Recap of the month of January …

The month started where the year had left off and we saw equity indices continue higher for the most part. At the highs the Nasdaq was up some 4.5 % and the HSCEI up some 11 %.

This finally ran into some position covering as the Reddit Army managed to force certain institutional players into major losses on their short positions. The liquidation of shorts then led to a reduction of longs too, leading to a decline in the overall indexes to close way off their highs for the month and, for the Nasdaq, flat.

Corporate earnings releases have seen mostly strong results being delivered across the board and that is helpful in providing a support to base further expectations off.

The news-flow around the pandemic vaccinations and hospitalisations heading into the end of January has turned positive and it is now a matter of time when we will be able to expect that the worst on this front is truly behind us.

The yield on the 10 Year US Treasury closed over 1 % for the first time since April 2020 and that is one data point to keep an eye on. The FOMC meeting heading into the close of the month continued its tone of last year and talked of “lower for longer” yet again.

While we have expected volatility to subside as President Biden settled down in office, this is yet to materialize. The recent liquidation of equity exposures has contributed to a further spike and it could be some time before markets settle down again.

We still expect monetary and fiscal policy to drive the macro environment for some time to come and these policy tools should provide a natural damper to continued excessive volatility.