December Monthly Review

A summary of key events and market trends during the month of December.

December saw a continuation of strength for the equity markets with most US indices closing at or near all-time highs

Now it’s over to 2021 !

What a year it has been!

And, how about that for an understatement?

2020 was a true roller-coaster ride. The Nasdaq went from up 11% till end-February, to down 20% till mid-March, to close the year up just shy of 50%, from the close of 2019

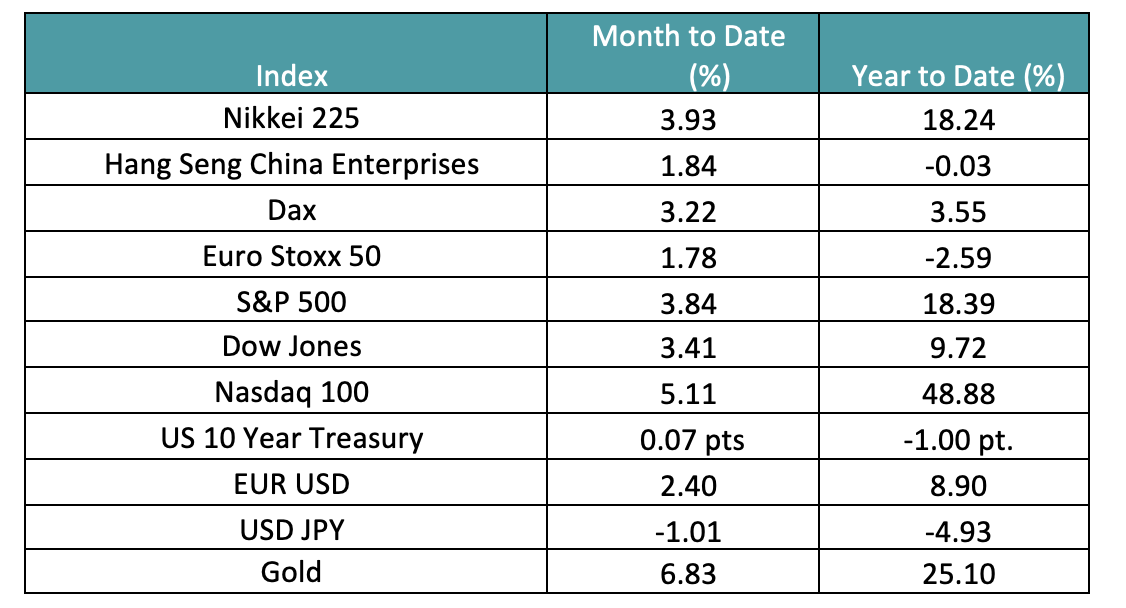

Key Markets

Key Trends

What a year it has been!

And, how about that for an understatement?

2020 was a true roller-coaster ride. The Nasdaq went from up 11 % till end-February to down 20 % till mid-March to close the year up just shy of 50 % from the close of 2019.

For a sheer recovery from the lows of March to the close of the year, the Russell 2000 Index (RTY Index – 2000 smallest companies in the US) made a move of north of 100 %.

While many companies, especially in the technology space, are producing strong growth we would credit these strong recoveries to the generous support that markets received from global Central Banks. The US Federal Reserve Balance Sheet expanded by some $ 3 trillion over the year. Minus the global easing, markets would have painted a quite different picture. It is what it is. And in this environment of abundant liquidity, risk assets are finding a strong bid. From equities to bonds to cryptocurrencies.

Brexit is now, we hope, firmly behind us and that should lead to UK assets normalising as the Brexit discount is priced out over a period of time. The pound now trades at the highest level since mid-2018 and should be well supported as we continue to expect the US dollar to come under pressure.

We await the US Senate election results for the State of Georgia towards the end of the week and the make-up of the Senate will be an important element in the evolution of the market outlook.

The vaccine roll-out is ramping up and more countries and regions are starting the process of vaccinating their populations. This will likely lead to economic normalisation in the second half of the year and we will be tracking the progress here.

We have a string of early data releases this week, culminating in the release of the Non-Farm Payroll numbers on Friday, 8th January. We would expect a further build-up of positive expectations heading into the inauguration of the new US President on 20th January and the following week has the kick-off of the first Federal Reserve meeting for 2021.

For the last couple of updates we have flagged the attention that crypto-assets have been receiving along with the resultant price action. This strength continued into the end of 2020 and we will be covering this space closer this year.

In conclusion, an environment of strong liquidity support will help provide a bid to asset prices and equity markets will be well supported. We continue to expect the US Dollar to remain under pressure. While the Volatility Index (VIX Index) currently holds over 20 we expect this to dip below that level as the year progresses.