Monthly Newsletter – May 2021

A summary of key events and market trends during the month of May

- The bulk of the reporting for the S&P 500 is out of the way and earnings and sales surprises have been seen across all industry sector

- The earnings adds to the improvement of the economic outlook for the year with the gradual reopening of economies and the continuation of stimulus packages

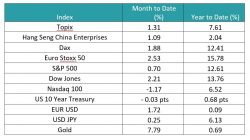

- The S&P 500 and the Nasdaq are marginally below the highs of April while the Dow Jones managed to trade higher

- The Volatility Index (VIX) closed below 17 which is the lowest since the March 2020 sell-off. Though it did see brief episodic moves over 20 during the month

Strong Corporate Earnings

An almost uniformly strong showing from companies this quarter

Key Markets

Recap of the month …

The month of May started with a large miss on the employment numbers with the change in Non-Farm Payrolls showing a paltry sub 300,000 jobs added in comparison with the meaty expectations of a million. This led to Federal Reserve Governors pushing back against the one-million-a-month numbers that were getting baked into analysts’ expectations. The next reading comes through at the end of the week.

Inflation numbers continued to surprise on the upside and for now Jerome Powell’s jaw-boning has managed to hem in ten year yields in a narrow range. The bond rally that ensued after the disappointing employment numbers was quickly reversed on the day which is testament to the stand-off for now between the rate bulls and bears. The next Federal Reserve meeting mid-June will provide some direction to yields.

Corporate earnings numbers for the quarter have been strong across all industry groups with positive earnings surprises for Consumer Discretionary almost 60 % higher than expectations.

There appears to have been a stall in the discussions and negotiations around a further US stimulus package with a few proposals being put forward by both sides; the middle ground of compromise is still elusive, however. This stalemate does not augur well for market expectations and the ball is now clearly in President Biden’s court to bring both sides together.

The US dollar continued trading weak versus the other majors and given the immediate soft employment data might keep the Federal Reserve on the backfoot for the coming months and quarters. The Feds metric of regaining all the jobs lost during the pandemic will likely take a longer period of time with the slower pace of jobs added.

The British Pound now trades at 1.4200, close to the highs from 2018 at around 1.4400. The progress with vaccinations in the UK has been on a firm footing and the likely reopening will be speedy too. A divergent central bank response will likely see the pair trade higher from here.

Precious metals have recovered ground lost against the dollar at the start of the year and we have used options on silver as a means to play this and capture some of the upside.

Given the steady economic backdrop and relaxed Federal Reserve monetary policy has seen a steady bid for risk assets and the VIX has traded mostly below 20. We do not see a reason for a major and enduring spike in volatility barring a volte-face by the Federal Reserve.