MONTHLY NEWSLETTER – SEPTEMBER 2022

October 1, 2022 |

Download Document

A summary of key events and market trends during the month of September

- The Summer equity rally quickly gave way to a rude awakening: global equity indices closed September at their yearly lows, hurt by a souring mood post negative inflation readings and fears of a looming macroeconomic slowdown

- The overall market move was brutal, with monthly returns ranging from -9.34% for the S&P500, -10.50% for Nasdaq and -5.66% for Eurostoxx, bringing yearly negative equity returns to an average of over -25%, meaning a quarter of valuations have been wiped out in 2022

- Corporate bonds are not faring better due to both an increase in interest rates (US 10-year rates moved up from 3.26% to 3.78%) and credit spread widening, brining yearly losses to -19.89%, the worst result in recent history

- The main issue remains inflation expectations: while the August print seemed to show that peak inflation was behind us, last month’s data worried investors, as it highlighted the stickiness of the current inflationary environment: core CPI came in at a higher than expected +6.3% year on year

- This means the Fed will need to inflict more pain to the economy and slow growth more aggressively than initially anticipated. More importantly, we believe the only way for inflation to substantially come down is for unemployment to increase, creating cascading negative effects to the economy

- Unsurprisingly, in this environment the USD continued strengthening, with the DXY index appreciating by over 3%

- Geopolitical tensions further heated up, with the Russian annexation of Ukrainian land creating a dangerous environment

- We are now approaching oversold territories across most asset classes and are only about 7% away to pre-covid highs in US equities. We are likely to test those levels but would foresee a strong tactical rebound from those levels at least in the short term

Sticker Inflation….

The latest CPI prints in Europe and US highlighted the difficulty required in bringing inflation numbers down.

We believe only higher unemployment can structurally decrease inflation, meaning more pain needs to be inflicted to the economy.

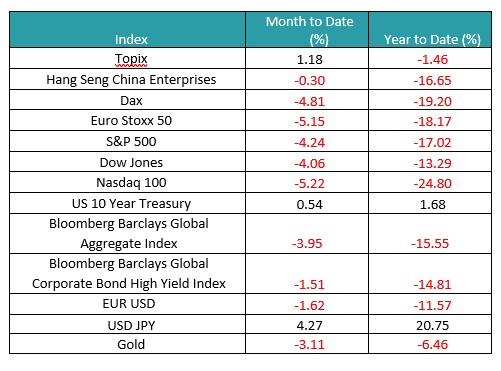

Key Markets

- One of the worst years for financial markets continues, with a September correction weighing further on yearly negative returns

- All developed asset classes are now deep in the red for 2022, including gold

- The strong USD appreciation can be seen especially against the JPY, which has lost over 25% of its value against the Greenback

- Even though the Fed is much further ahead in its hiking path compared to the European Central Bank, yearly equity performances are very similar across the Atlantic (S&P500 -24.77%, Eurostoxx -22.80%), highlighting the impact of US markets on the rest of the world and signaling that European market remain susceptible to a further correction as the ECB needs to still tighten a lot more

- Both high yield and investment grade bonds have been suffering close to 20% yearly losses, emphasizing that both interest rate increases and credit spreads have impacted the sector

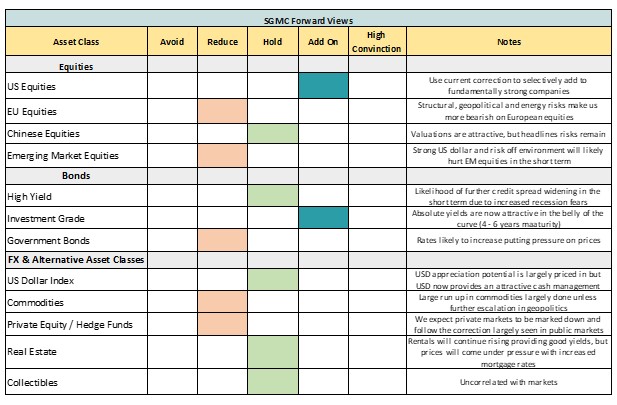

SGMC Forward Views …

- June lows have now broken and a further in equity valuations seems likely given the deteriorating macroeconomic and geopolitical environment

- In the short term we are reaching strong support levels and oversold territory, therefore a strong short term bounce cannot be ruled out

- Longer term, the upcoming earnings season will be crucial in better forming forward guidance and analyst estimates for the following quarters

- We remain more supportive of American equities as compared to European ones, as the Ukrainian tensions, energy crisis as well as continued tightening by the ECB will weigh on valuations

- In the fixed income market, we see value in the belly of the curve for both USD and EUR denominated investors, who can now receive 7% and 6% respectively for an investment grade portfolio with an average duration of less than 4 years