MONTHLY NEWSLETTER – SEPTEMBER 2023

A summary of key events and market trends during the month of September

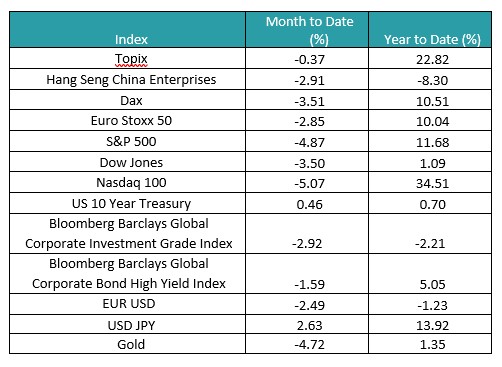

Global Markets Updates

- The summer holding pattern continues as most traders and investors return from their summer holidays. The top-of-mind question now is whether we see a final push higher heading into the end of the year or if the move higher on rates derails the economy and markets altogether.

- We have for some time not expected rates to move considerably on either side of the current levels and this view has proven to be accurate.

- Markets are pricing in the mild possibility of rate hikes – only half a hike out to November 2023 – and then around 4 rate cuts, totaling 1 percentage point, out to December 2024.

- Our base case is for the slim possibility of one hike over the next few months with rate cuts coming through only when inflation or growth come off significantly from the current still elevated levels.

- With the cost of money no longer zero, stock picking for the medium- to long-term will be key to delivering portfolio out-performance.

- The Artificial Intelligence theme continues to dominate investors’ attention and separating the key players from the also rans will be an important factor for consideration.

- Earnings season is wrapping up and all sectors of the S&P 500 delivered a positive earnings surprise with Consumer Discretionary beating the most versus expectations (+ 19 %)

- The Volatility Index (VIX) continues to dwell under the pivot level of 20 and despite brief moments of frenetic activity heads to the lows since the pandemic with some ease. We look to hedge portfolios with cheap hedges given these levels.

Government shutdown shenanigans

The US Government narrowly averts a shutdown as House Republicans finally agree a path forward. While this will cool short-term volatility the issue will likely re-surface in November as the actions taken now are only temporary. .

Key Markets

- As we head into the last quarter of the year, we look to the Bank of Japan closely to determine if and when they alter their stance on monetary policy. The BoJ has run Quantitative Easing since 2000 and now owns considerable chunks of the Japanese Government bond market and parts of the Japanese equity markets too. A change from dovish to hawkish, while not imminent, is clearly important to keep an eye out for.

- With equity markets performance strong for most of 2023 we look to reduce outright exposures while using long optionality to play potential upside while also hedging downside risks. The low cost of volatility allows for this strategy to be feasible. We also look to sell volatility on stocks that we like to own into declines and this single stock volatility tends to be considerably higher and hence works in our favor.

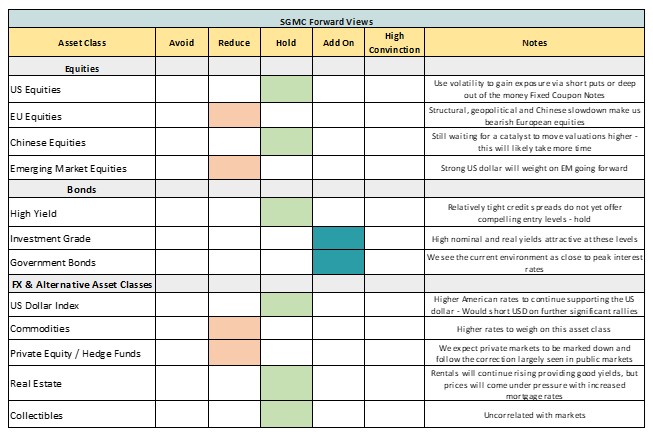

SGMC Forward Views …

- We downgraded Chinese equity assets to hold, as further visibility in terms of political and business environment is required in order for a meaningful rally to materialize and be supported

- We upgrade our call on investment grade corporate bonds and government paper as we expect the current interest rate environment to be close to the peak, hence the yields offered by the market both in nominal and real term are compelling