MONTHLY NEWSLETTER – OCTOBER 2025

A summary of key events and market trends during the month of October

Global Markets Updates

- With overnight interest rates now at 4% and some push back from Fed Chair, Jerome Powell, the key 2 year US Treasury Bond trades at an yield of just around 3.5%. This indicates that while some additional easing is expected it is not a whole lot more.

- With rates starting at 5.5% (at the previous peak) we are now a good 150 basis points lower and most expectations are for rates to bottom out at the 3-3.5% range.

- The push and pull from the simultaneous events of the government shutdown along with the thematically turbocharged re-industrialization of the economy is leading to winners and losers across the board.

- For now the US Banking system appears to be robust and earnings numbers from the largest names of the sector continue to be firm. This is both across trading and investment banking revenue as well as traditional interest income.

- The Artificial Intelligence push across the economy is creating a host of opportunities; and not just restricted to only what is traditionally hardware or software. The key spending currently is on the data center build out which involves not just the construction sector but also importantly all manner of cooling and ancillary systems.

- Start-ups in the space are not focused, again, only on traditional tech start-up themes but are involved in turning around, with the aid of AI, all manner of traditional businesses and wringing out efficiencies from operations across sectors from hospitals to logistics to manufacturing.

- The energy generation needs of the data centers and the various manufacturing initiatives is leading to heavy investment into currently natural gas facilities and we believe down the road, not now, into nuclear facilities too.

- Overall, risk appetite remains robust and, while we are not in the cheapest of markets, there continues to be value available for long term investors

ONE STEP FORWARD

At the recently concluded US China talks there appears to be some progress toward positive outcomes with both sides backing down from their most extreme stances

The AI / Tech rally sees no cessation with a broadening and change of leadership within the sector a healthy sign

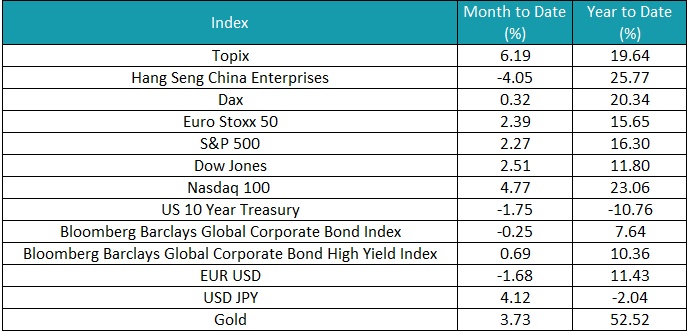

Key Markets

- October has been another positive market for most equity indices, with the major exception of China and Hong Kong, with the Shanghai Index closing flat (-0.10%) while the latter declined over 4%

- The strong corporate results of tech companies together with exciting growth prospects for the sector continue Nasdaq’s outperformance trend, which closed the month near all time highs after a +4.77% monthly return

- It was a very volatile month for precious metals, with gold skyrocketing to all time highs of USD 4,381 after declining and closing October just below the 4,000 mark

- Similar trends have been seen also in silver, which spiked 17% in the first two weeks of the month after declining and closing with a 4% gain

- Europe managed to close in positive territory too, with Eurostoxx keeping a similar pace to the S&P500

SGMC Forward Views …

- No changes to views this month