MONTHLY NEWSLETTER – OCTOBER 2024

A summary of key events and market trends during the month of October

Global Markets Updates

Most equity markets were hit in the last two trading days as some “disappointment” in earnings caused the over-optimistic to trim exposures.

We use quote marks here, as overall the earnings numbers are unambiguously strong. We note that US Banks posted very strong core gains and expect this to continue as the softer rate outlook buffers real estate prices.

China, after some strong price action in the previous month, has flat-lined as investors balance out their optimism for growth with the unclear path for infinite stimulus.

We have had only a tactical approach to China for the last year and do not see anything that would suggest that we should change the approach here.

The continuing strength of the US economy has meant that interest rates have given up some of the excess pessimism that had been priced in.

While at the end of September the rates markets had expected the low point in 2025 to be around 3% the outlook one month on is around 50 basis points higher. We do not see this as a negative as we prefer a stronger economy with a higher rate profile.

Around 70% of the S&P 500 companies have reported earnings and we see a small positive surprise on top-line revenue and a larger positive surprise with regards earnings.

Volatility spiked with the late-month sell-off in asset prices and we expect it to be elevated until the final election outcome. This gives us the opportunity to restart selling options to earn premium for portfolios and create entry points for our preferred stocks.

US ELECTIONS 2024 …

All eyes focused on what will be a closely contested race. Having lightened up our exposures heading into the event we will evaluate portfolio action post-results

Key Markets

- As would be expected, the road to the early November elections has been a rocky one. This time more than usual given an assassination attempt and the bowing out of the earlier Democratic candidate, sitting President, Joe Biden.

- Politics in the US has been increasingly polarized over the last decade and this shows no signs of letting up. The external manifestation of this polarization can be viewed ubiquitously on various social media platforms as well as on leading media platforms.

- The political center, where the bulk of compromise and deal-making is done, has been somewhat abandoned for the fringes where positions tend to harden and get less prone to bipartisan policy-making.

- Today one of the key polarizing issues is the approach to women’s autonomy and health and the provision, or restriction as the case might be, of the choices available to deal with this matter.

- While a good part of the US populace has it’s share of concerns with the performance of the economy and their inability to “get ahead” we would note that a number of competitor countries would be happy to have “the problems” the US does.

- Inflation is still not comfortably below the Federal Reserve’s upper bound of 2% and we expect with the strength of the economy to actually find it hard to achieve this outcome. As a function, interest rates are not likely to come off as much as the markets currently price in.We do not view this as necessarily a bad outcome for markets as the positive drivers of the Artificial Intelligence juggernaut as well as the nascent Reindustrialization initiative will likely provide positive outcomes for some quarters ahead.

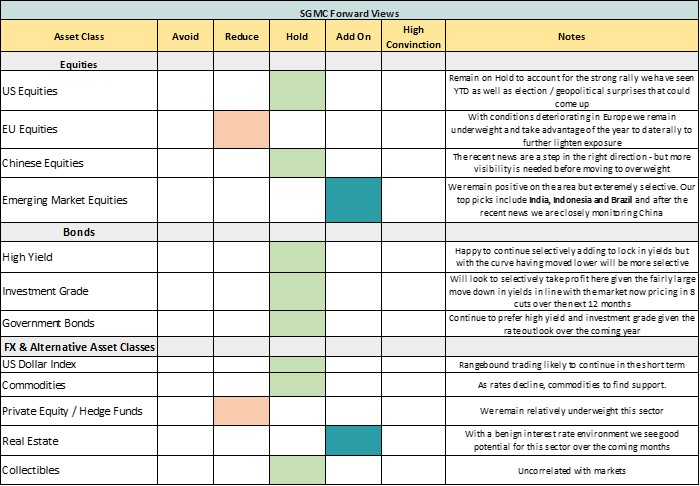

SGMC Forward Views …

- No changes to current allocations