MONTHLY NEWSLETTER – NOVEMBER 2025

A summary of key events and market trends during the month of November

Global Markets Updates

- Bets on near term rates have moved in the last month from a high probability of a December cut to low and now back to high with recent Federal Reserve data showing a tick down in the outlook for employment in the US.

- The volatility of the outlook on near term rates along with some lack of visibility (now improving) from the lack of economic data has led to a fair amount of profit taking being exacerbated by bearish and bubble talk.

- As we have stated our view on equity valuation is subjective at best and we focus on the underlying metrics and dynamics of the businesses that we own – when those dynamics are strong we are happy to buy into declines and exit on rallies and if not we are happy to sit on the sidelines.

- The earnings numbers from two of our key holdings, Nvidia and Palantir, have been nothing short of spectacular.

- While other holdings continue to deliver strong results too, this pair are redefining the key technology categories; hardware and software. From our experience over the years tracking Global Markets we tend to remember the adage : High quality growth is rarely available cheap.

- We believe it is also hard for many investors to see, in real time, deep paradigm shifts playing out. Investing history is replete with examples of companies that were early to a new game (think Amazon, Facebook and even Microsoft in the mid-’80s and Nvidia in the mid-’90s) and their equity, as it turned out, was eventually undervalued at the very moment the strongest growth was about to be delivered.

- We view the current set-up similarly, with some segments viewing Artificial Intelligence as being the latest shiny thing. We believe it is a shiny thing albeit with tremendous and true promise and we expect the AI Revolution to lead to renaissance across personal and corporate computing.

- The last month has seen some deleveraging and this should lead to a healthy reset from which any further potential rally in asset prices could be based off.

BLOWING BUBBLES?

Some prominent bears have emerged and are talking about bubble-like conditions prevailing across some or most parts of global markets

Per our note from last week we continue to see developments and promise of the arc of technology as positive

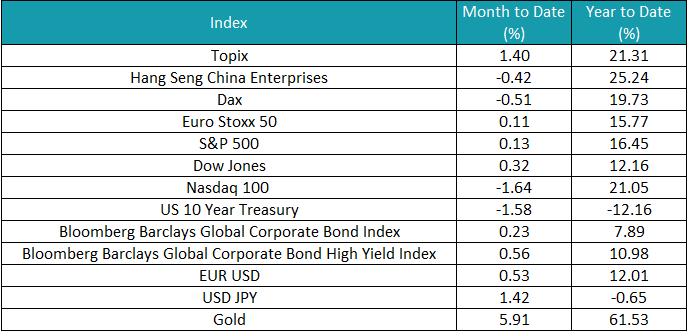

Key Markets

- November has been a rocky period for most global equity indices, which closed the month flattish to negative

- The American technology sector (Nasdaq) has been one of the most severely hit, with fears over excessive valuations dragging the index lower by 1.64%, even though year to date returns remain very strong at +21.05%

- Japan was the main outlier: thanks to the recently announced ambitious fiscal plan it managed to edge out another positive month, with the Topix closing at +1.40%

- Gold continues its stellar run, with geopolitical tensions and overall demand lifting the precious metal to over USD 4,200 per ounce, equivalent to more than 60% gains in 2025

- USD denominated fixed income investments benefited from a decline in longer term US rates lead by increased expectations of a December cut, resulting in another positive monthly return for the sector

SGMC Forward Views …

- No changes to views this month