MONTHLY NEWSLETTER – NOVEMBER 2024

A summary of key events and market trends during the month of November

Global Markets Updates

As 2024 comes to a close the annual ceremony of predicting investment outcomes for the next year will be well indulged by the sell-side of financial markets.

We expect that after two strong years of performance the instinctive reaction will be to gun for a continuation.

This is where extreme market positioning could come to work against the consensus optimism – i.e if everyone is already bullish, then who is left to buy incrementally ?

Our practice is to well digest the opinions as well as see how the first month of trading (January) shapes up to then discern likely courses of action.

For now, current themes will likely continue to resonate : Technology and Artificial Intelligence, Re-Industrialization of the US, Interest Rates lower with around 4 rate cuts by end 2025 and the US Dollar continue to be bid into any sell-offs.

China saw an end-of-Summer rally; however, since then optimism has been fading. The odd Technology company bobs up or down based on the latest news or results and then we have the almost never ending bleak property related news flow. Our stance of trading China tactically appears correct and we stick with that conviction for now

Post-election volatility did not increase and has quickly collapsed to just two percentage points off the recent and long-term lows. We expect volatility to spike at some time in the coming year but for now expect it to be subdued.

DONALD TRUMP IS BACK…

And this time around it feels like we understand him a good deal better. This possibly takes away some of the surprise of his Presidency ? We will be watching this space closely

Key Markets

- As we head into the final month of 2024 the focus switches to the possibility of a Christmas Rally developing as investment houses that have underperformed to date start chasing equity returns. We see no need to amend our allocations and will benefit from upside momentum with long call options.

- We will use the next couple of months to digest the narrative and price action and as key indicators of the likely further developments for the rest of 2025.

- As always, geopolitics is a potential wild card and any negative developments here will require us to re-assess our theses.

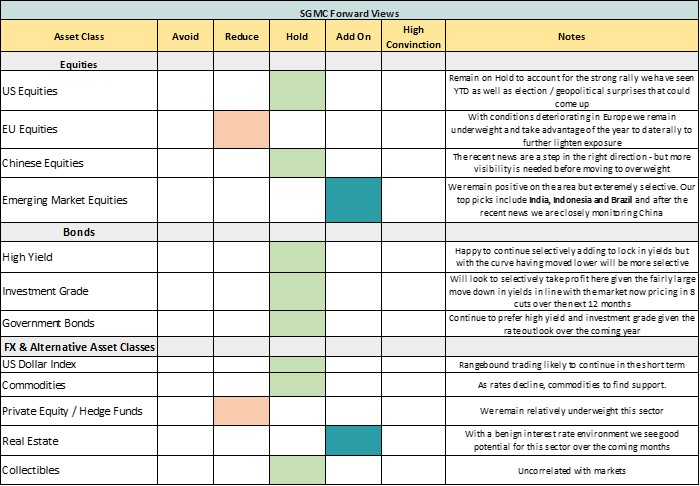

SGMC Forward Views …

- No changes to current allocations