MONTHLY NEWSLETTER – NOVEMBER 2022

December 1, 2022 |

Download Document

A summary of key events and market trends during the month of November

- Risk asset markets ended the month of November strong with Federal Reserve Chair Powell suggesting the possibility of a soft-landing for the economy, more contained price pressures and hence, a more muted response from monetary policy

- The S&P 500 ended up just over 5 % for the month while the Nasdaq gained 5.5 %. At the same time our preferred sector, Semiconductors, was up over 18 %

- Inflation, while still high in comparison with long term averages, now shows a significantly lower profile from just a couple of months ago, showing that central bank policy is feeding through to the broader economy

- China has had another volatile month. Since the conclusion of October’s CCP meeting towards the end of October the broad HSCEI Index has fallen 10 % to new lows since the Great Financial Crisis and then rallied 30 % off that base. This has been accompanied with further volatility around protests around still uncertain progress with the re-opening of the economy

- We broadly expect the country to continue to move steadily towards further re-opening and would use any further dips as buying opportunities

- The US Dollar Index (DXY) has reversed all of its gains since July and the commodity currencies of Australia and New Zealand have been the best performers recently.

- The Volatility Index is now flirting with the psychological pivot level of 20 (currently 20.50) and if the “mood” in financial markets stabilizes at the current levels we could see it break below with the attendant impact of more robust risk appetite, especially heading into the end of the year

Still no pause… but we’re getting there….

The US Fed is now indicating that the pace of further rate increases will be muted.

The Interest Rates markets now expect a peak rate of around 4.9 % by June 2023

Key Markets

- With the US Federal Reserve indicating a nearer end to ultra-tight policy the markets are taking a breather and bargain hunters are looking for cheap assets to allocate to

- As US earnings season draws to a close roughly 75 % of reporting companies have met or exceeded their revenue and earnings numbers. The notable laggards were the Communications sector (social media and advertising focused names in particular) which are feeling the brunt of slow advertising spend as well as Industrials and Materials sectors which have not been able to pass on cost increases to customers

- China continues down its slow path to opening up its economy and despite short term challenges we expect that the direction is now well set

- Since mid-October the US Dollar has given up all the gains since July and will likely see some pressure for the remainder of the year. The Japanese Yen has gained over 10 % from its recent all time low of around 152 vs the USD.

- Despite stark challenges in Europe risk markets there are holding up very well in the last couple of months. Geopolitical risk is not off the table and we continue to monitor developments in Eastern Europe.

- We continue to like the fixed income markets and look for opportunities to build our allocations

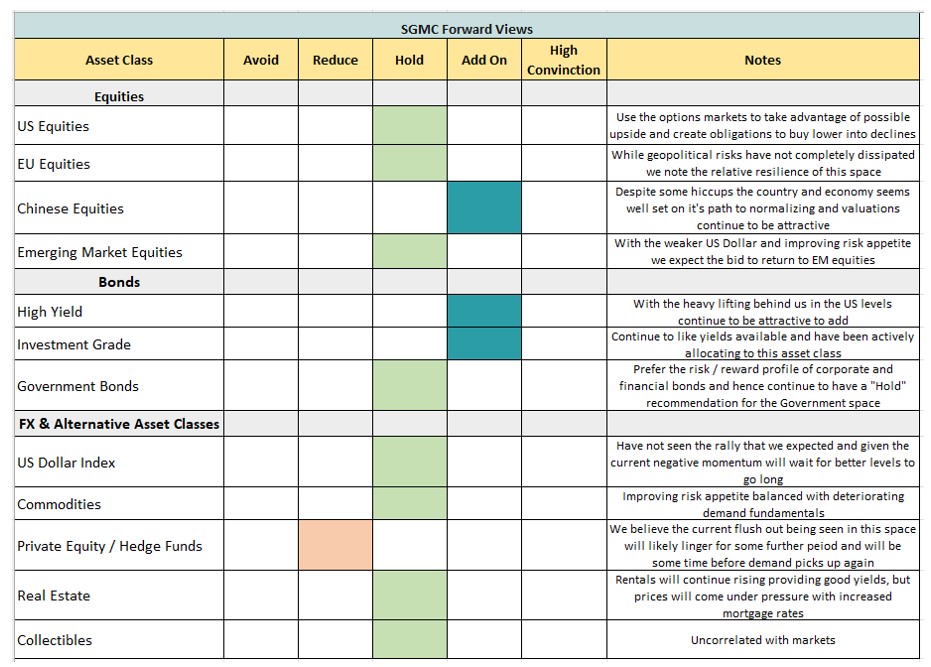

SGMC Forward Views …

- November has closed the month strong and we expect the momentum to likely continue. This is especially true given the significantly reduced levels of risk appetite in broader markets mean that investors will need to play catch-up with their allocations as we head into the end of the year.

- With the recent press conference of the US Fed Chair indicating a slower path to further hikes markets have reasons to cheer a potentially lower final rate as initially feared

- With a divided US Congress President Biden will have to deftly negotiate his agenda for the next 2 years. We will monitor the resultant fiscal policy and its impact on markets

- Chinese equity markets seem to have found a bottom after the disastrous market outcome of the recent Party meeting and continue to have plenty of room to catch up to their international peers, making the equity upside from here continue to look attractive