MONTHLY NEWSLETTER – MAY 2025

A summary of key events and market trends during the month of May

Global Markets Updates

- The Federal Reserve kept its benchmark interest rate unchanged at its early May meeting, maintaining a “wait-and-see” approach in response to persistent inflation and economic uncertainty. The Fed’s minutes and subsequent policymaker speeches were closely watched for signals on the timing of potential rate cuts, especially in light of tariff-driven price pressures. We do not expect this stance to change unless we see a dramatic lurch in the outlook one way or the other.

- Given the level of policy flux, we expect to be relatively patient with our macro assessments as we see the pull as well as push of policy decisions taking some time to form a coherent picture.

- The 2nd estimate of US GDP for Q1 confirmed an annualized contraction of 0.3%, ending an 11-quarter growth streak. Rising recession fears despite continued strength in consumer spending and private domestic demand appear to skew the outlook.

- While the April jobs report (released in early May) showed a solid gain of 177,000 jobs and a steady unemployment rate at 4.2%, analysts noted a marked deceleration in job growth. The labor market is expected to cool further, with monthly job gains projected to slow to around 90,000 later in 2025, partly due to declining net immigration and the impact of tariffs on business confidence.

- In Europe the picture appears a bit bleaker with growth assessments being downgraded and disinflation likely around the corner. This belies the performance of the European equity markets; partly explained by the renewed push to defence production and some rotation out of the US which had dominated global markets over the last five years as global markets recovered from the Covid shock in 2020.

- Volatility continues to be overall subdued despite short and sharp rallies on risk news. We remain sellers of volatility into heightened levels to add overall yield to the portfolio.

ON AGAIN / OFF AGAIN

Tariffs are negotiations and negotiations are tariffs. We have run through the full gamut of negotiation positions and now with most tariffs on pause a close eye is being given to full and final discussions with various trading partners.

Key Markets

- Looking at monthly returns, Nasdaq 100 clearly stands out as the main winner with a + 9.04% rally, thanks to both depressed starting levels as well as very solid quarterly earnings announcements from the American tech companies

- European equities continue to defy gravity and prolong their extraordinary run: Dax added another + 6.67% in May to reach yearly returns of over 20%

- An increase in longer term rates as well as a marginal widening in credit spreads lead to the Global Corporate Bond Index (investment grade) remaining relatively unchanged in May (-0.36%)

- The risk-on environment was not beneficiary to gold, which nonetheless managed to remain at the same elevated levels

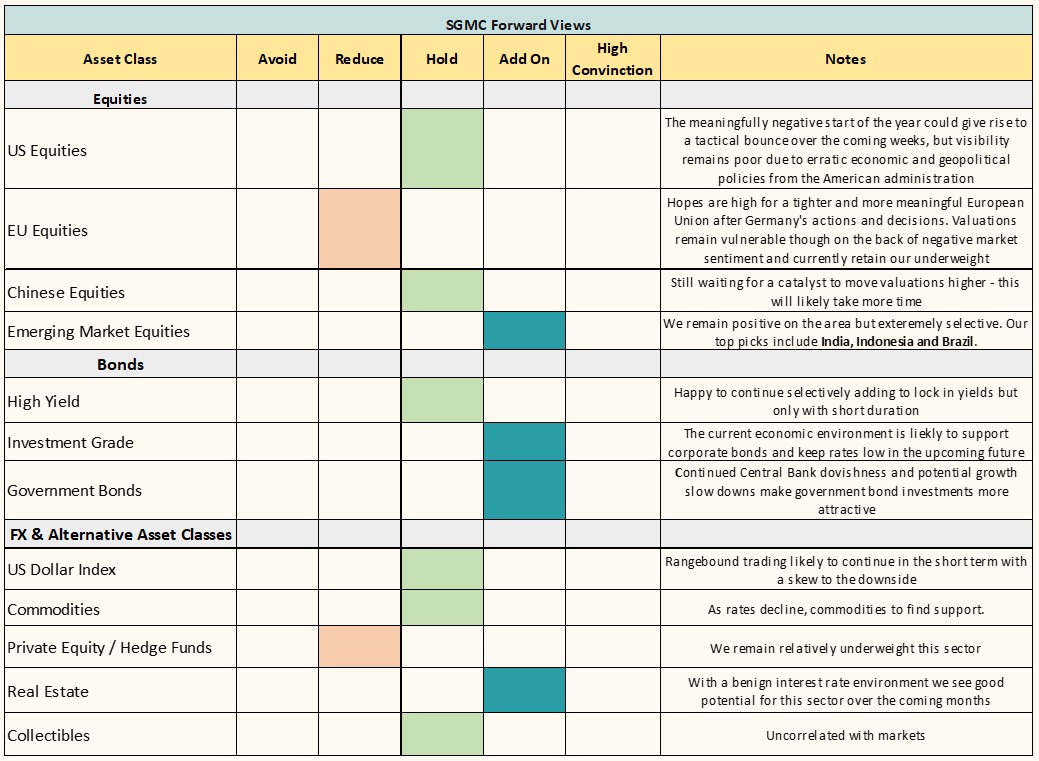

SGMC Forward Views …

- No changes to views this month