MONTHLY NEWSLETTER – MAY 2024

June 1, 2024 |

Download Document

A summary of key events and market trends during the month of May

Global Markets Updates

- Equity markets are climbing back to and exceeding previous all-time highs as, in the main, corporate earnings continue to be robust. Having said that weak forward guidance is seeing individual companies being penalized in the short-term.

- Still with only around one and a half cuts being priced in to the interest rate markets till the end of the year there has been not much to cheer for investors holding off for lower rates

- We continue to focus on the core growth and cash-flow fundamentals of companies that we prefer to own and as such our portfolio strategy is not reliant on more or less cuts.

- Nvidia, the poster child of the current rally keeps belting out faster chips and higher sales. We are optimistic about outcomes for the semiconductor industry; having said that, it has now been a “much loved” sector for most of the last 12 months and as such we see future gains moderating.

- Polling in India now complete we look forward to the results and barring any untoward surprises should see the Narendra Modi government and the BJP be given a strong mandate.

- China’s equity markets softened this month after a good recovery of the lows from earlier in the year. Policy measures and regulatory action have turned supportive especially with respect to the property sector. We stand ready to buy the dip should that occur over the coming months.

- The Volatility Index (VIX) has stayed closer to the lower end of the recent ranges and while the geopolitical climate may cause it to head higher we expect it to be fairly stable in the short term

Markets back to all-time highs ….

Yet, investors wait on Central Banks’ final dovish capitulation

Key Markets

- While markets trade at all-time highs, it is encouraging to note that global growth is holding steady. The US continues to plug ahead and while some numbers have come off the boil recently we expect the Federal Reserve to stand ready to lower rates to support growth should the need arise.

- China growth numbers too have been firm and after months of weakness. Also regulatory pressure appears to be reduced as companies are provided with better visibility. We expect Asia to be a favored region for global investors for the coming months.

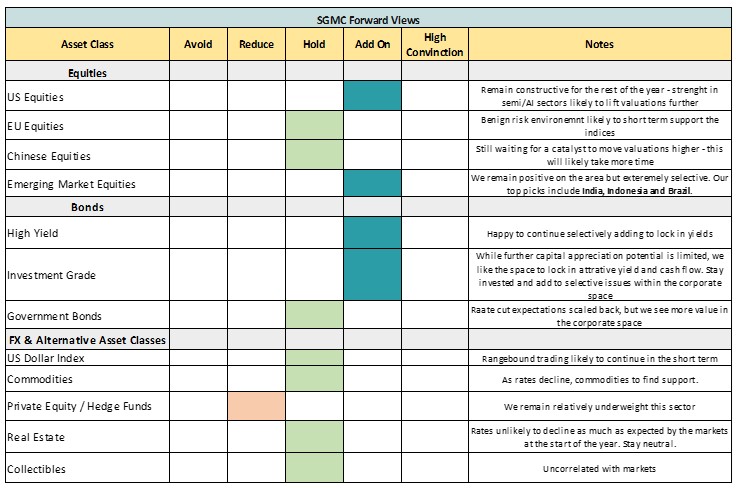

SGMC Forward Views …

- We have not made any major changes in our forward views as compared to last month

- Overall, we believe the constructive environment in global equities will continue over the coming months