MONTHLY NEWSLETTER – MARCH 2025

April 1, 2025 |

Download Document

A summary of key events and market trends during the month of March

Global Markets Updates

- Global economies and corporates are adjusting to the new reality of US Trade and Industrial Policy. Over the last two odd months there has been substantive talk of tariffs and counter-tariffs and as we write we expect President Trump’s Liberation Day announcements to come through within the next few hours.

- Economic activity appears to have taken a hit in the US with a somewhat different, and positive, impact in Europe as European countries invest more heavily in their own economies. The recent ISM manufacturing data is a case in point with lower readings across all growth and employment metrics.

- Inflation is on the rise too. As tariffs are implemented and factored into the calculations we will see the net impact of the rapid shift in policy seeping through partially into higher inflation expectations and the balance impacting corporate bottom-lines.

- Global equity markets have been quick to price in this new reality with Europe and China delivering strong positive returns leading the negative performance from the US. Some part of this is correcting for the prior two to four years of US outperformance.

- US Technology and AI related stocks have been hit particularly hard in 2025. We are confident that these names will continue to deliver strong and above-average growth over the medium term. As a case in point, there are now fairly regular outages occurring with some of the leading LLM service providers; this is a function of massive surge in demand and bodes well for semiconductor chip manufacturers, the LLM providers and the rest of the ecosystem. This is a secular trend of increased productivity and higher growth and we are happy to ride the volatility of the price action in the short-term.

- We are closely evaluating incoming policy decisions and will look to adjust portfolio exposures should we see a continuation of this trend over the longer-term.

BRACING FOR TARIFFS

Tariffs, Retaliatory and Counter-Retaliatory are the present focus of politicians, investors, economists and business-people

Key Markets

- China continues to perform strongly this year with multiple initiatives being taken to shore up investor confidence. This allows for almost five years of underperformance versus the US indices to correct; though only marginally at this point.

- Even after the strong China outperformance this year, from April 2020 to date the total return for the HSCEI is around 8% versus 140% for the S&P 500 and 165% for the Nasdaq 100.

- Geopolitics continues to play out in the background and this contributes to an overall volatile picture. Despite this the Volatility Index (VIX) has been relatively steady with only being marginally higher than the pivot level of 20

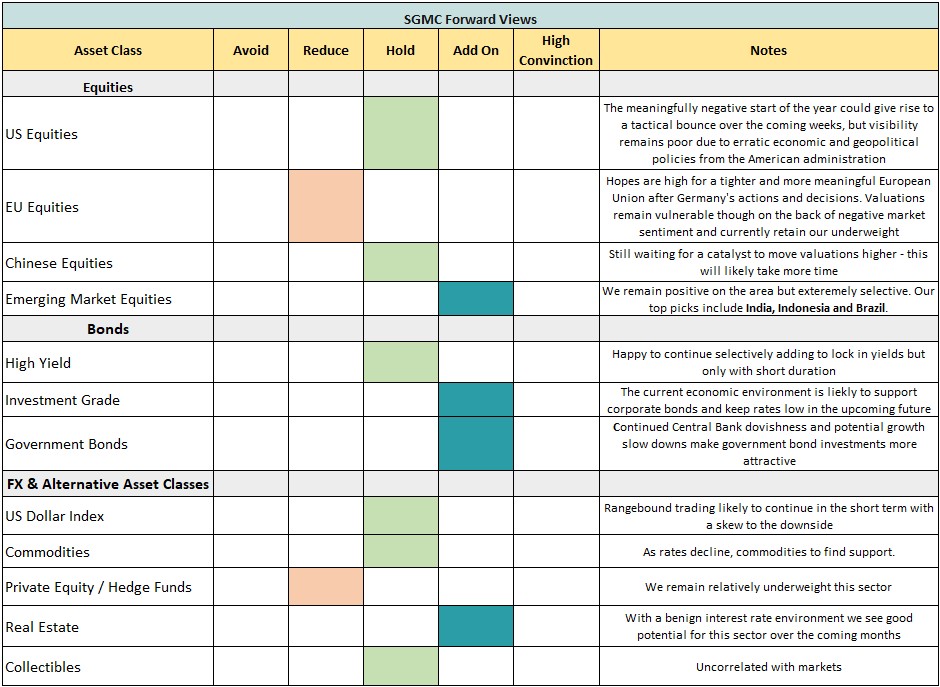

SGMC Forward Views …

- No changes to views this month