MONTHLY NEWSLETTER – MARCH 2024

April 1, 2024 |

Download Document

A summary of key events and market trends during the month of March

Global Markets Updates

- The strong growth in the US economy continues as the upcoming employment numbers are expected to exceed 200 K for the fourth month in a row. While wage inflation data eased during the last report overall job creation is solid

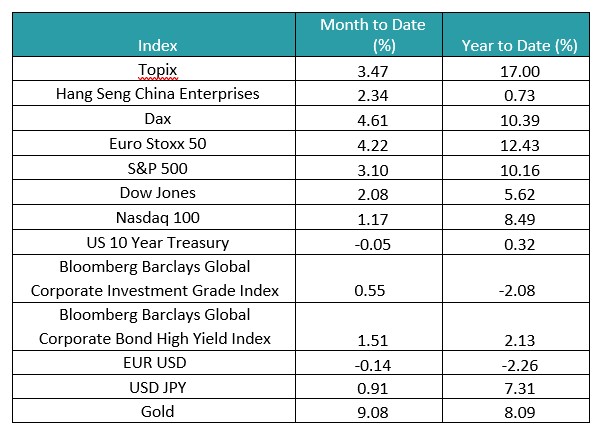

- March has seen technology oriented stocks take a breather and strength has rotated into the broader indices like the S&P 500. In fact, since the start of the year the S&P 500 now marginally outperforms the Nasdaq 100. While in Europe the Dax and Euro Stoxx 50 continue to find support with better valuations encouraging investors that are looking to pay lower multiples

- Japan continues to hold and build on its strong performance with the Nikkei closing over the 40,000 mark for the first time ever

- A broader equity rally indicates strength from the leading sectors flowing through to the supporting segments of the economy and speaks to the health of the current state of the economy and the market rally. We kick off the next set of quarterly reports in two weeks with the large cap US Banks and will be keeping a close eye to check on any anomalies that may develop while higher rates take some steam out of the economy

- We have had a slew of Central Bank meetings in March, with the meeting at the Bank of Japan being the most historical and critical. With interest rates raised into positive territory for the first time since 2016 it appears the Bank of Japan is seeing signs of inflation and optimism finally coming back

- Federal Reserve Chair, Jerome Powell, has been equivocating on US interest rates and his most recent comments indicate a patient approach to any potential cuts. He cites the strong economic data as reason to hold back. Having said that, The Fed continues to expect 3 cuts for this year

- The Volatility Index (VIX) continues hovering around 13 which is closer to the long-term lows for the index

Taking a breather

After two strong months of performance in global equity markets we appear to be seeing a pause – we continue to expect markets to head higher over the course of the year

Key Markets

- Manufacturing data from China in March appears to show that stimulus measures of the government is helping the recovery pick up. We would need to see continuing signs of strong data to expect a turn in sentiment

- The US Dollar had a strong showing in March and gained against the Euro and the Japanese Yen. The Yen appears to be on the defensive despite the move to positive rates as the Bank of Japan continues to anchor rate expectations at low levels. On the other hand, they and the Ministry of Finance have been warning market participants of impending intervention should $ JPY break the 152 mark. We watch developments here closely as the ensuing price action could have an impact on overall market volatility

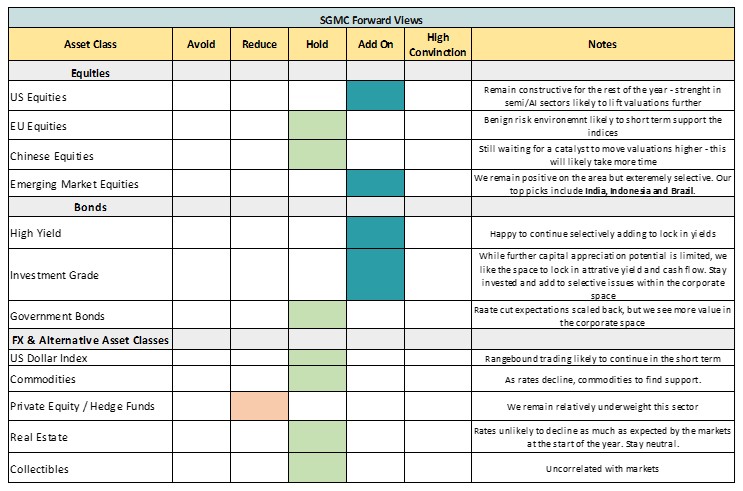

SGMC Forward Views …

- We have not made any major changes in our forward views as compared to February

- Overall, we believe the constructive environment in global equities will continue over the coming months

- Selectively adding corporate fixed income exposure looks attractive at these levels given the additional dovish turns most of the global Central banks have taken in March (apart from the Bank of Japan)