MONTHLY NEWSLETTER – JUNE 2022

A summary of key events and market trends during the month of June

- Another leg down for global equity markets puts the first half performance for this year as the worst in almost five decades with the technology focused Nasdaq Index down 30 % from the start of the year

- The rise in inflation appears to be slowing but more importantly not coming off as much as policy makers would like and we are still seeing headline numbers in the high single digits

- Commodity prices are off the highs with copper trading at the lowest level in a year and off 20 % from its recent peak. Energy prices too are lower, and off 15 % from the highs in March

- Interest rates have been tracking inflation higher and markets now price a peak overnight Federal Funds rate of around 3.50 % in March 2023

- Given the current yield curve and the widening of credit spreads, we are seeing attractive levels of fixed income new issues come to market

- Corporate results for the upcoming quarter will reflect the slowing growth picture and markets will digest the lower sales along with efforts that individual companies make to protect bottom line profitability

- The Volatility Index continues to trade lower than the peaks of late last year and earlier this year and indicates that good part of positioning unwind could be out of the way. Anecdotally, we are hearing the recent declines in valuations has led to considerable selling among levered investors and this could portend reduced selling in the coming months as markets overall contend with slower pace of growth

Federal Reserve playing catch up?

The Fed surprised markets with a 75 bp rate hike and signaled potentially more to come?

Key Markets

Recap of the month …

After a relatively quiet month of May, June saw further acceleration to the downside in asset prices. This is primarily off the back of continuing high inflation and the Federal Reserve response to the same. Other global Central Banks also are in tightening mode with the Swiss National Bank surprising markets with an interest rate hike.

The exceptions to the tightening are the People’s Bank of China and the Bank of Japan which continues to exert considerable pressure in the fixed income markets by holding the yield on the 10 year bond at 25 basis points and in the process buying up close to half of the overall Japanese Government bond issuance. This dovishness in turn has weakened the Yen to levels not seen over the last 2 decades or longer in certain cases. China will likely continue to provide stimulus to the economy, and indirectly to markets, while the restrictions on physical movement as part of their zero-covid policies are in place. This is likely transient and support likely end as the country recovers from the lockdowns.

Japan is in the unique position of having to deal with, till recently, decades of chronic deflation and policies in place there address their unique situation. The rest of the world today contends with high inflation and while prices have moved significantly higher over a one-year period, shorter tenor views show some moderation.

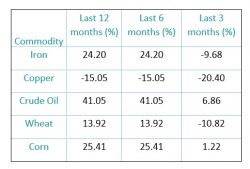

Commodity prices : The last 3 months has seen prices of various commodities moderate while the longer periods out to one year prior are still elevated

The twelve-month view in the chart above shows how prices are significantly higher from a year ago while negative or significantly less positive on a three-month view. As higher interest rates pressure prices lower and with the impact of base effects we would expect inflation to moderate in the coming months.

The Federal Reserve is now expected to hike overnight rates to peak of around 3.50 % by March 2023 and with the two-year US Treasury bond currently trading at 2.90 % we would expect their current level of hawkishness would be sufficient to tame inflation. The upcoming FOMC meeting in July should see another round of a 75 basis point hike.

The European Central Bank has indicated a path to higher rates at their next meeting and this has led to wider credit spreads for the debt of the Eurozone periphery. The market will need to see evidence of a credible plan to keep spreads anchored while monetary stimulus is rolled back and this will be the key focus for their policy meeting in July.

The Volatility Index (VIX) trading at around 29 indicates there is a continuing bid for protection against lower equity prices. Having said that the index traded north of 35 towards the end of 2021 and earlier this year too and this indicates that the bulk of the hedging could have been put in place already. We continue to watch the evolution of volatility closely as we head into the earnings season.