MONTHLY NEWSLETTER – JULY 2024

August 1, 2024 |

Download Document

A summary of key events and market trends during the month of July

Global Markets Updates

- Our call to move US equity to Hold from Add was timely as markets hit a rough patch during the month. The sell-offs were primarily triggered in the sectors which have done well year-to-date (primarily Technology related).

- While the upside scenario has seen somewhat of a pause, we did see an active amount of buying coming through towards the end of the month, on the last day to be precise.

- With many market leaders having lost around 15 – 25 % of their valuation from their recent highs investors with cash on the sidelines were looking for bargains. An on-balance dovish Jerome Powell suggesting a September rate cut possibility helped investors pull the trigger on purchases they had on the radar.

- The interest rate markets now price in three 25 basis point cuts till December and we are leaning towards this outcome; something that we have been calling for from the start of 2024

- We are now in the final stages of the US Election cycle and with President Biden dropping out of the picture in favor of Vice President Harris the dynamics of the race are indeed complex. VP Harris appears to be building strong momentum; though the odds are still in favor of Former President Trump winning majority of the electoral votes. We expect a keenly contested race and will provide updates as pertinent to policy and markets along the way.

- Geopolitical flash-points continue to put downward pressure to asset prices and we will also take defensive action on portfolios should the same be warranted in the coming days.

SHARP UPTICK IN VOLATILITY…

Stretched valuations lead to some level of profit taking and rotation; long-term technology bull case unchanged

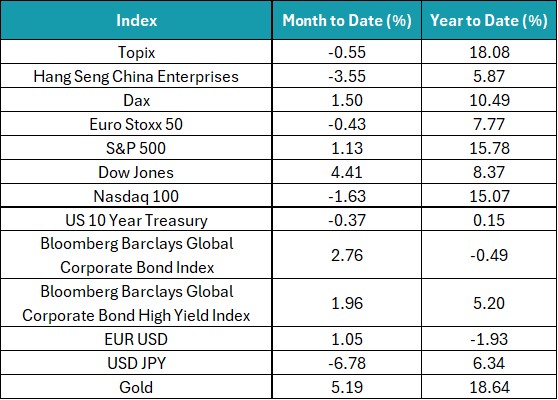

Key Markets

- Volatility in markets spiked this month especially in the Technology heavy Nasdaq. This has been on account of a few factors and started with investors locking in gains to then reducing allocations on account of geopolitical tensions. We still view the Technology sector through a secularly bullish lens but, and as we mentioned in our last update, are happy with our move to Hold on US equities in general.

- All this is playing out with an interest rate profile which is markedly dovish compared to last month. In the recent FOMC press conference Fed Chair Jerome Powell alluded to a September rate cut. With the usual caveats as well of the forthcoming data being in line with that dovish profile. Jobs and other growth numbers will be keenly watched in the coming weeks and having said that the interest rate markets are already pricing in 3.5 rate cuts by the end of this year.

- Of late the potential outcomes of the US Presidential Elections are proving to be as volatile as equity markets.

- From Joe Biden’s seeming decline, the assassination attempt on Donald Trump, the former dropping out of the race and endorsing Kamala Harris, to her surge in popularity. There are still three critical months ahead and we believe the final outcome is still wide open.

- In Japan, the Central Bank raised rates again and this has triggered a Yen rally and a sell-off in equity markets. However, with the year-end interest rate around 40 basis points there will still likely be a large gap to most other currencies. We would be happy to buy Japanese equities after the first flush of selling and when we see some stability build.

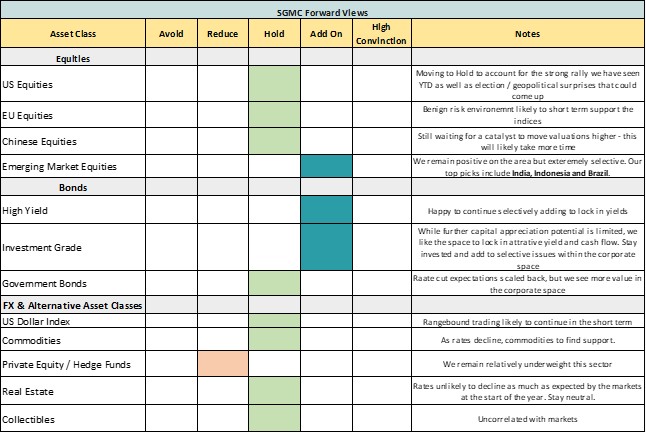

SGMC Forward Views …

- We have not made any major changes in our forward views as compared to last month