MONTHLY NEWSLETTER – JULY 2022

A summary of key events and market trends during the month of July

- July saw one of the best months for risk assets since 2020 with investors reading the recent Federal Reserve meeting as dovish.

- While inflation has not turned lower in the US, prices of many commodities are down significantly from their recent and all-time highs.

- Wages and rental prices are proving to be a lot stickier, however and we believe it will be some time before the likely slowdown in employment will start detracting from the inflation indices.

- From a peak in overnight Federal Funds rate of around 3.50 % interest rate markets now price in a slightly lower peak at 3.25 % in February 2023.

- More than half the S&P 500 companies, representing around 70 % of its market capitalization, have reported earnings. There have not been many significant surprises and most of the large cap names have reported good numbers and forward guidance.

- The Volatility Index now trades at its lowest level since April and indicates a lower need to hedge exposures. At a reading of 21 it is close to the important pivot level of 20 and while we do not expect short-term risks to abate completely, we expect a breach of that level to occur in the next few months. We continue to look for opportunities to trade volatility and enhance portfolio returns.

Looking forward to rate cuts in the US?

Not so fast … while the market is pricing in the full first Fed rate cut in May 2023 we believe that inflation may yet prove to be sticky in the short-term and hence that is not worth bringing front and center at the moment

Key Markets

Recap of the month …

If there ever was textbook dovish hike, what Jerome Powell delivered at the end of July would be a leading candidate for that moniker.

Raising rates by 75 basis points for the second time in succession and calming markets anxious about the expectations for further hikes Powell’s actions and post-meeting press conference has reduced the anticipation of continuing tight policy.

We do not expect this to now immediately translate to easy policy going forward. Inflation readings are still coming in high and services businesses continue to be able to raise prices. In particular wages and house rents are proving to be intransigent.

Having said that, given the multiple rounds of negative headlines investors have been subjected to since the start of the year, investors were positioned for a far worse outcome. The net post-meeting outcome was investors re-allocating to risk assets with determination and led to July being the best month for equity prices since 2020. We are of the view that barring significant negative news from the Ukraine conflict the markets could have seen a durable short-term bottom during the lows of June.

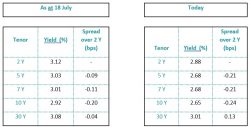

Curve inversion : US Treasury yields still inverted out to 10 years – more sharply at the front end and the 30 year vs 2 year un-inverts; a minor positive.

Corporate results, not surprisingly, haven’t been the most optimistic and yet given investors’ recent pessimistic expectations have been better than feared. We continue to expect the large cap technology names to deliver stronger than expected results as they position for a slower growth world but have considerable leeway given their strong value propositions and resultant healthy cashflows and balance sheets.

The US has recently had positive developments by way of constructive policy. The $ 52 billion CHIPs For America Act has received bipartisan support and should be signed into law by President Biden imminently. On the cards is another sweeping work of legislation which would address health care, tax reform and climate change. At north of $ 400 billion, this again will likely generate a fair amount of upside to the economy as investment is made in critical areas and includes provisions for it to be self-funded and is expected to generate a surplus, thus contributing to a reduction in the deficit.

We expect Western European economies to continue to feel some pressure as the European Central Bank does it’s best to curtail inflation while firms and individual consumers contend with poor visibility on energy supply. The hit on sentiment over the last six months cannot be overstated.

Regulatory policy in China continues to rein in the consumer technology sector and there is not much visibility as to when this would end. Further, the real estate sector continues to lurch from one issue to the next; the latest being rampant non-payment of dues on under construction projects. This has prompted the government to announce measures to support the sector as well as the broader economy but more is needed and at the moment does not seem to match the pace at which it is required.

We expect the levels of asset volatility to slowly grind lower as investors realize the unwinding pressure on levered positions over the last six months has likely run its course. We now trade at around 21 on the index and very close the pivot level of 20 below which more allocations to risk assets would be expected.