MONTHLY NEWSLETTER – JANUARY 2026

A summary of key events and market trends during the month of January

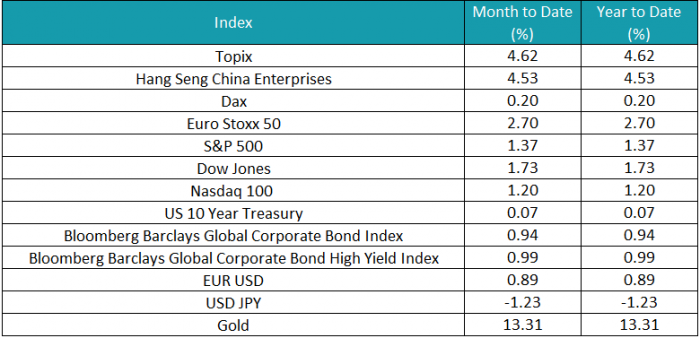

Global Markets Updates

- January was a busy month for global markets with a fair part of the conversation being monopolized by precious metals. First, on the way up which saw Silver record a one-month gain of around 70% only to collapse 26% on the last trading day – still up for the month but on shakier ground.

- Our preference to primarily invest in productive assets (equity and bonds) as compared to scarcity assets (silver and gold) leaves us mostly on the sidelines of the ‘investing’ in precious metals debate; though we do closely watch the evolution of the environment around the dramatic price moves to understand the read through to other asset classes.

- With some market participants ostensibly expecting an uber-dovish Fed Chair appointment there was some selling across the board when that did not develop.

- With the last few years delivering strong returns across most equity markets we see the possibility of more muted returns in 2026 as a distinct possibility. The overall price action in January tends to confirm our expectation.

- Another narrative that has been doing the rounds in global commentary has been the end of US exceptionalism. Again, we tend to take the other side of this debate as, for better or worse, with the unique strengths that the US possesses, both absolute and relative, we do not expect a significant change in the global order of things.

- Geopolitics in 2026 appears as murky as ever with recent developments in South America and the Middle East creating cause for concern. We view these concerns as binary and to date they have not impacted our view on global asset markets but, as always, we monitor closely.

- The Volatility Index at present indicates some continued calm; though events of the last week suggest that we will see some reversion to mean from elevated levels. We welcome increasing volatility as it rewards our patient approach to not chase markets to extremes.

A new Fed Chair?

January saw some gyrations in global markets as winning themes from 2025 were taken to an extreme and then lost ground as the month closed

Kevin Warsh as prospective Federal Reserve Chair we believe is a good choice given his credentials and we expect markets will steady before long

Key Markets

SGMC Forward Views …

- No changes to views this month