MONTHLY NEWSLETTER – JANUARY 2024

February 1, 2024 |

Download Document

A summary of key events and market trends during the month of January

Global Markets Updates

- A fairly uneventful January and the Japanese Topix Index has taken the lead with a strong outperformance for the month. Multiple factors including stronger corporate governance and a focus on shareholder returns contributing to the overall returns

- Early US corporate results are coming in mixed and that has led to a slightly tepid performance on the markets. Having said that with fairly easy monetary policy expected for the next 12 months we would not be too concerned about overall outcomes for the economy

- At its meeting yesterday the US Federal Reserve pushed back on rate cut expectations. While the market continues to expect close to six 25 basis point cuts for the full year, we come in closer to three

- We note that multiple equity markets are making new long-term highs and, in some cases, all-time highs. In the current low volatility environment there is some probability that a benign macro outlook draws investors in to chase prices up

- Such chase, if it were to occur, would need a catalyst in the form of a “sexy” story. We believe the theme of Artificial Intelligence could very well fit that bill. We’ve been around when the dot com boom took place and see the potential for AI to be the new poster child

- To be clear we are early, committed and continuing believers in the fact that Artificial Intelligence will shape our world in the coming years and that commercial enterprises that tap this potential will strongly outperform others. Having said that we believe that the markets at times will get ahead of themselves and that we might be on the cusp of such a move

- The Volatility Index (VIX) continues to trade at sub-20 levels and at times a low 12 handle. Global geopolitics could easily push this higher and we expect to comment on that situation a good deal more than in previous years. For now however, with the index at around 14 the markets appear to not see the need to protect portfolios

Steady as she goes …

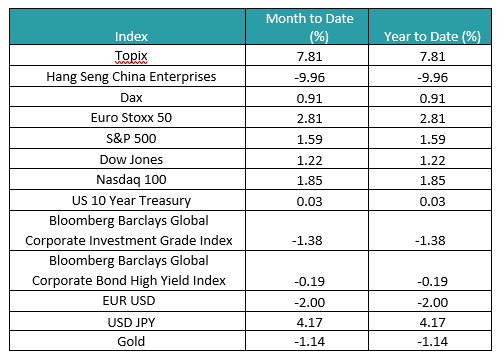

Most markets have started 2024 in an undramatic fashion and we aren’t surprised with that given the wide dispersion of views that now exists. Japan (+7%) and China (-9%) are the outliers.

Key Markets

- The global geopolitical situation continues to get increasingly complex and, particularly, the Middle East situation likely does not see quick resolution. With the US heading into an election year and with multiple flashpoints heating up we expect news flow around geopolitics to be a potential source of negative market reactions through the year

- As a result and further on the back of very strong markets in 2023, where now valuations are not as attractive, we are slightly lighter on equity positions than last year

- We own call options to play any equity upside and will look to use structured products to create potential entry points into our preferred stock names at discounts from current price levels while earning attractive yield for the portfolio

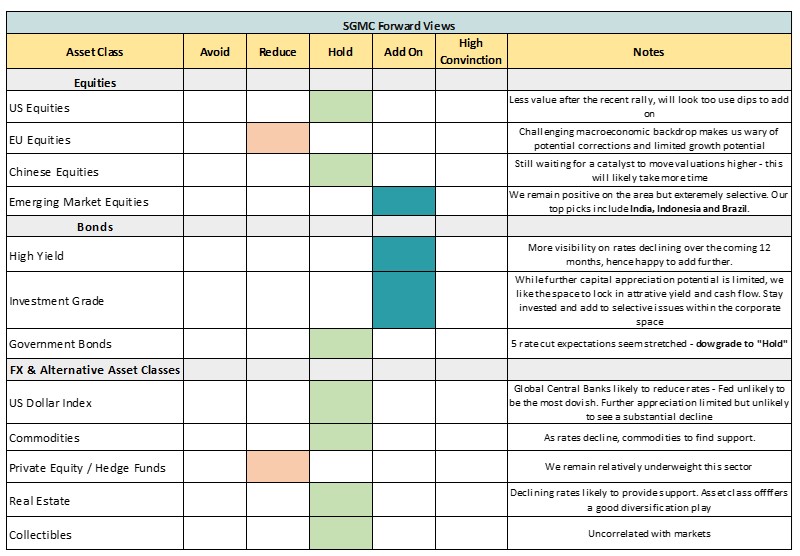

SGMC Forward Views …

- Overall we remain mostly constructive on fixed income assets, which give you an attractive yield and cash flow in a benign environment of declining interest rates

- This being said, we downgraded government bonds to “Hold” from “Add On” after the recent decline in yields and current overly optimistic market expectations of over 5 cuts throughout 2024 in both Europe and the US

- Withing Emerging Markets our preferred geographical focus is Asia, with India and Indonesia in particular