MONTHLY NEWSLETTER – JANUARY 2023

February 1, 2023 |

Download Document

A summary of key events and market trends during the month of January

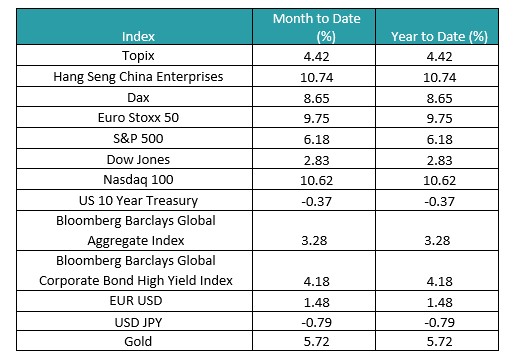

Global Markets Updates

- Asset prices have had a good start to the year with most equity indices, bonds and commodities posting gains for January.

- The technology heavy Nasdaq has rallied in excess of 10 % as investors looked for bargains in the excessive bearishness at the end of 2022.

- China continues to open its economy and lift restrictions and this re-opening process is leading to a dramatic turn in the economic data which we believe has some further room to run.

- Inflation continues to moderate but central banks will want to keep up the pressure to ensure second round effects from still stubborn wages do not become endemic.

- Several upcoming central bank meetings including the Federal Reserve, European Central Bank and the Bank of England are likely to continue the process of monetary policy tightening and this puts a ceiling on how high asset prices rally.

- Earnings season is under way and we will be watching results closely along with management guidance for 2023.

- The Volatility Index (VIX) has recently been closing below the critical support of 20 and this will induce flows into risk assets. We keep an eye out for events that could alter this dynamic as that would be critical for portfolio positioning.

Relief rally or something more substantial ?

With most major central banks removing liquidity from the financial system we continue to be positioned tactically

Key Markets

- The assessments at the end of last year by most of the industry indicated a cautious approach to the first half of the year and to that extent the month of January has delivered a contrarian outcome.

- With the first Federal Reserve meeting coming through tonight and setting the tone for the coming months we would reserve judgement with which way markets break from here.

- There is a somewhat balanced perspective between a more hawkish or more dovish perspective : On the more hawkish side inflation has still not come off enough for any central banker to claim victory over inflation while on the dovish end of things the strongest set of interest rate hikes and tightening seen in decades would eventually and certainly slow economic growth and cool inflation.

- The Federal Reserve has set a higher bar for where they expect interest rates to peak (just over 5 %) over the next 12 months compared to the bond markets expectation of a peak under 5 % coming through earlier in the year (mid-June).

- The European Central Bank and Bank of England are expected to follow suit tomorrow as headline inflation is a continuing concern.

- We continue to like the fixed income markets and look for opportunities to build our allocations.

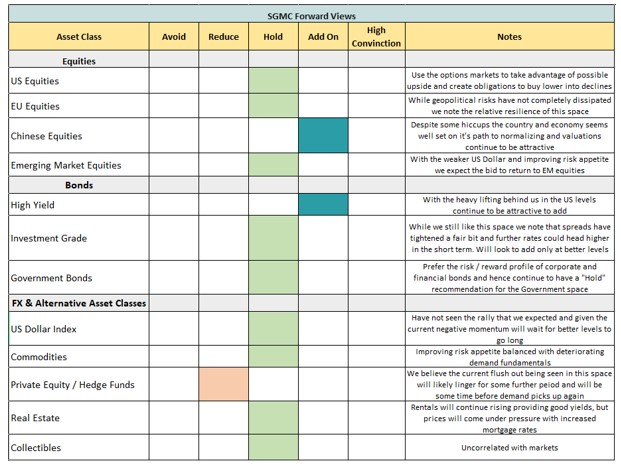

SGMC Forward Views …

- We are currently not making any changes to our forward views and asset allocation. Though, this could change as we assess the tone and content that comes through from the monetary policy meetings over this week and the next.

- We would look to use any declines in prices to accumulate strong businesses that we like for the long term.