MONTHLY NEWSLETTER – FEBRUARY 2025

March 1, 2025 |

Download Document

A summary of key events and market trends during the month of February

Global Markets Updates

- The net impact of US policy on the economy and financial markets is still in the balance. On the one hand the Republican pro-business approach is a positive and on the other, tariffs and seemingly large lay-offs in the Government sector could be a drag.

- Continuing uncertainty, if unchecked, will likely drown out optimism and slow or hold back spending and investment decisions. While this assists in resolving inflationary concerns we need to monitor the impact on business and consumer confidence.

- European stock indices have this year handsomely out-performed their US peers. We expect this to be a short-term phenomenon as the fundamentals for sustained business growth do not appear to be attractive. We monitor and reserve longer-term judgement on the potential for a strong and unified European response to the global geopolitical situation; and especially as it relates to Ukraine and Russia.

- Chinese equity assets have re-rated well this year. This comes after a sustained and three-year underperformance versus the US. We continue to play China at a macro level while taking tactical exposure through broad market indices.

- The strong pace and developments stemming from the adoption of Artificial Intelligence technologies continues. Market-leader Nvidia Corp. released earnings last week that showed sales growth and earnings power continues unabated. We suspect the heady days of growth will now lead to strong sustained cash flow and investors will likely profit from this in the form of enhanced share buybacks down the road.

- Despite the positive performance many of the leading Tech and AI names are taking a breather while shorter-term investors take some exposure. We believe longer-term investors should stay the course.

US TAKES A BREATHER WHILE THE REST CATCH UP

US equity markets, particularly the Tech Sector, lost favor while investors bought into China and Europe

Key Markets

- 2025 has started off with Europe and China putting in strong performances while the US has lagged. This appears to be a shorter-term rotation from the pricier to the cheaper markets and does not, in our view, indicate a long-term shift.

- Geopolitical risks have re-emerged this year and the shifting news on tariffs and sanctions is cause for some concern among global investors. We monitor events here and are ready to hedge or add exposure according to concerns and opportunities as they arise.

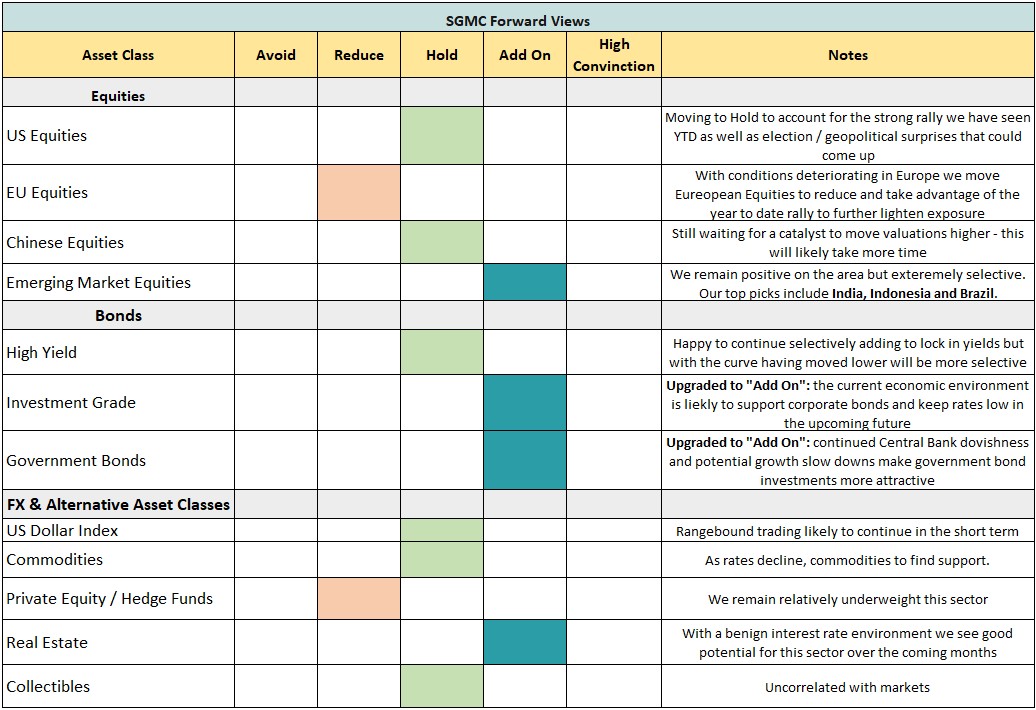

SGMC Forward Views …

- We upgrade both investment grade corporate bonds and government bonds to Add-On. The current macroeconomic environment coupled with renewed Central Bank dovishness and potential growth slow downs make fixed income investments more appealing, with a stronger likelihood of rates staying low (and potentially lower) for longer

- We maintain our equity positioning unaltered while closely monitoring the European equity situation. Should the current environment be the catalyst for a strong affirmation of shared intent, increased cohesion between member states and bold moves supporting the Union (like a common army), this could lift Europe’s prospects and we then turn more bullish