MONTHLY NEWSLETTER – FEBRUARY 2023

March 1, 2023 |

Download Document

A summary of key events and market trends during the month of February

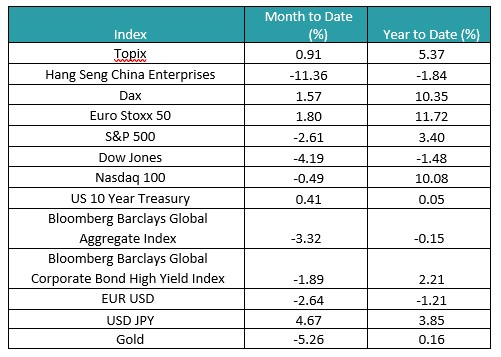

Global Markets Updates

- As expected, asset markets in February have given up some of the strong gains recorded in January. Most broad market indices have retained their positive performance with the notable exceptions being China and the Dow Jones.

- The former has been hit by multiple geopolitical events while the latter has seen lesser buying interest.

- Given the depressed valuation levels in technology, Nasdaq held up relatively better while still recording a negative monthly return of -0.49%.

- Balloons, (Anthony) Blinken and Bao Fan’s disappearance hit confidence in China. Having said that the authorities continue to support markets and we expect the economy to gather momentum as the year progresses.

- Inflation continues to be sticky and while goods and manufacturing inflation has come off considerably the uptick in services inflation continues to be problematic.

- With growth and inflation continuing to come in towards the higher end of expectations the rates markets now price in higher terminal rates. The US overnight rate is seen peaking at around 5.4 %, 0.6% higher than at the start of February.

- Similarly, rates in Europe are seen around 0.65% higher to about 4.0 % in twelve months. Various ECB Governors are taking a hawkish line when discussing policy.

- We will now look at the ISM Services data which is forward looking to assess whether January was a positive blip or if the US and other economies are in fact accelerating.

- Most corporates have reported quarterly results and while top line numbers have mostly met expectations the bottom line has disappointed primarily in the Communications sector.

Uptick in US economic data is pushing terminal rate expectations higher

Europe too is seeing higher terminal rates with the ECB talking hawkish

Key Markets

- The Federal Reserve now meets towards the end of March and while the broad expectation is for another 25 basis point hike in rates there are some analysts calling for 50 basis points. This expectation will be fine-tuned as the month progresses and the activity and Non Farm Payroll data over the next few days will set the tone.

- The change of guard at the helm of the Bank of Japan is being closely followed by the investor community. While Kazuo Ueda, the nominee for the Governor’s role when current Goveror Kuroda steps down, has been provided a good amount of airtime to voice his views on policy he has, as expected, stuck close to the existing script of continuing support for the economy. Any deviation from this plan that arises will likely trigger volatility in Japanese asset markets and potentially have ramifications for global assets too.

- The headlines of potential Chinese support for the Russian military effort is concerning given the potential for increased sanctions on Chinese firms. We watch these developments closely as any escalation would hit investor confidence.

- We continue to like the fixed income markets and look for opportunities to build our allocations.

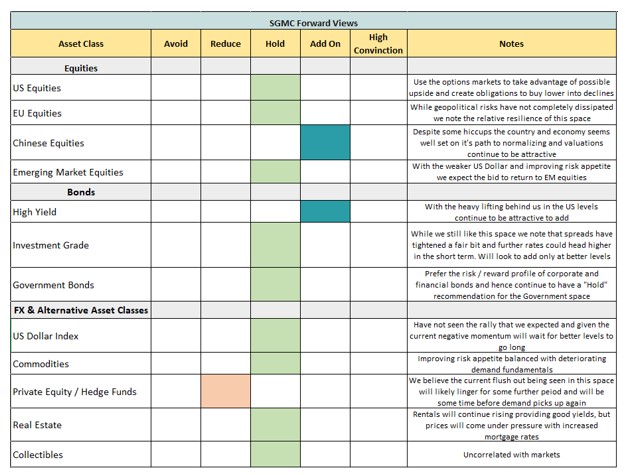

SGMC Forward Views …

- We are currently not making any changes to our forward views and asset allocation. Though, this could change as we assess the tone and content that comes through from the monetary policy meetings over the coming weeks.