MONTHLY NEWSLETTER – DECEMBER 2025

A summary of key events and market trends during the month of December

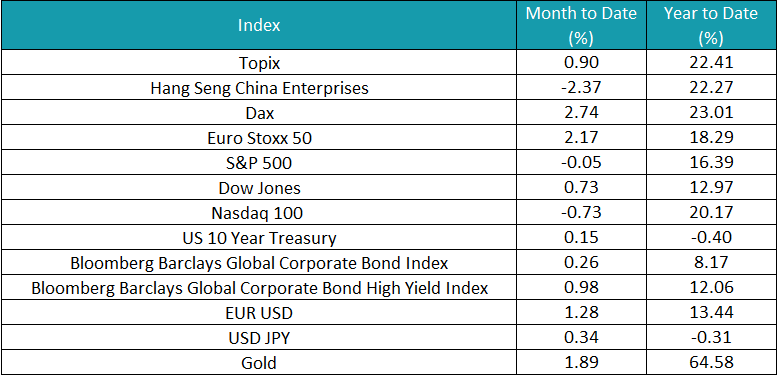

Global Markets Updates

- The announcement of sweeping tariffs on “Liberation Day” (April 2) triggered a sharp selloff, with the S&P 500 shedding roughly $3 trillion in value in a single session. But the 90-day suspension that followed produced one of the largest single-day rallies in decades—the S&P 500 surged 9.5%, its best day in nearly 17 years. Markets ultimately learned to live with a 10% baseline tariff on most imports, with higher rates on select trading partners.

- After holding firm through mid-year, the Fed delivered three consecutive 25bp cuts starting in September, bringing the target range down to 3.5%–3.75% by year-end. The rationale shifted from inflation concerns to protecting a cooling labor market, though rates remain well above pre-2022 levels.

- Unemployment rose to 4.6% by November—a four-year high. Layoffs jumped 54% year-over-year as businesses responded to uncertainty and invested in AI efficiencies. A “K-shaped” economy persisted: higher-income consumers spent robustly, while lower- and middle-income households pulled back.

- The eurozone proved more resilient than expected, growing 1.4% for the year as domestic demand and robust labor markets offset trade headwinds. The ECB completed a cumulative 200bp of rate cuts, bringing the deposit rate to 2.0%, and held steady at year-end with inflation hovering near target at 2.1%.

- A mid-year EU-US trade deal capped most tariffs at 15%, limiting the damage from transatlantic tensions. Defense and infrastructure spending—particularly in Germany—emerged as new growth drivers, while the manufacturing sector remained a weak spot.

- Beijing achieved its “around 5%” growth target, with the IMF projecting 5.0% for the year, but the underlying picture remained unbalanced. Property investment contracted nearly 16%, remaining the economy’s largest drag, while exports provided crucial support—growing over 6% and contributing the lion’s share of GDP growth.

- Rather than launching large-scale consumption stimulus, policymakers focused on local government debt swaps and targeted industrial support. Deflationary pressures persisted throughout the year, and the transition to a consumption-led growth model—a stated objective of the 15th Five-Year Plan—remains more aspiration than reality.

THREE YEARS AND COUNTING?

Global equity markets took a bit of a breather in the last couple of months of 2025 but still delivered strong performance despite building on the prior two years

Attention now shifts to 2026 and particularly the choice of the new Federal Reserve Governor coming up

Key Markets

SGMC Forward Views …

- No changes to views this month