MONTHLY NEWSLETTER – DECEMBER 2024

A summary of key events and market trends during the month of December

Global Markets Updates

The start of the new term of the Trump Presidency will likely lead to adjustments being made by multiple economic and market participants.

We have noted that this second term will likely be better understood / read by the market and continue to see signs of more surprising policy pronouncements being taken with the appropriate pinch of salt.

Another key factor that appears to be defining this term is the proximity of Silicon Valley, through primarily, but not limited to, Elon Musk.

One of the hot issues taking shape is immigration policy with a wide swathe of participants chiming in on the topic. Apart from this, policy around growth initiatives will be closely watched.

The tensions and negotiations between the US and China will likely get harder to read as President Trump looks to establish the best deal for the US while using his trademarked style of diplomatic interactions.

Europe may as a result be caught in some sort of crossfire between these two countries and has its work cut out as far as the growth policies it needs to push through – whether these are delivered or not is to be seen.

Asia too will need to deal with more elemental policy decisions; having said that the buffer from some of the strongest demographic trends in many parts of the continent continue to be a strong tailwind.

ANOTHER YEAR OF STRONG EQUITY GAINS

Where do we go from here ? Having been ahead of the curve and unequivocally bullish over the last two years we now see multiple paths with regards the evolution of asset prices in 2025

Key Markets

- Given the almost unilateral bullish calls for markets in 2025 we tend toward skepticism with regards this outcome. At the same time, we do not expect a destructive sell-off in high quality assets. This leaves us with a larger expectation of a range-bound market as a base case with smaller probabilities of a large decline or rally.

- The Artificial Intelligence juggernaut continues to roll full steam ahead. While some companies now enjoy rich valuations we do not believe that the most optimistic outcomes have been priced in currently. The technology, and not just Generative AI, will continue to develop and provide new avenues for growth in coming years.

- As always, geopolitics is a potential wild card and any negative developments here will require us to re-assess our theses.

- We will use the next couple of months to digest the narrative and price action and as key indicators of the likely further developments for the rest of 2025.

- As always, geopolitics is a potential wild card and any negative developments here will require us to re-assess our theses.

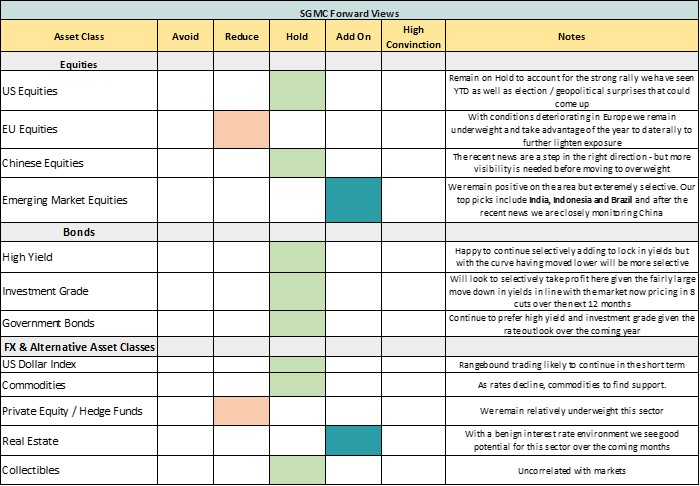

SGMC Forward Views …

- No changes to current allocations