MONTHLY NEWSLETTER – DECEMBER 2023

January 1, 2024 |

Download Document

A summary of key events and market trends during the month of December

Global Markets Updates

- We have to go back to 1999 to find a year where the Nasdaq 100 index did better than 2023. And the rest of the global equity markets rose in unison as central banks belatedly acknowledged what markets had long perceived; the end of the aggressive hiking schedule.

- China continues to signal that regulators will act firmly against business and business models which are not aligned with the longer-term plans for the economy. This approach has not been welcomed by investors and they have voted with their feet and are actively looking for alternate avenues.

- One such avenue is the broader Asian expanse which not only sports better demographics but also strong infrastructure spending and pro-growth policies. From the Middle East to India, in particular, to South-East Asia multiple centers of growth are kicking in.

- We expect a benign interest rate environment for 2024 and that should support investor flows into equity assets for the most part. The interest rate markets have already priced in 7 cuts each of 25 basis points till January 2025 and hence there will be room for hawkish data surprises in this scenario and we would expect to play those opportunities tactically long as we do not see the possibility of the Federal Reserve moving back to hiking territory for some time.

- Growth in Europe should be slower than most regions as China continues its slower than usual pace. And as result the European Central Bank will likely also move to rate cuts in earnest during the course of the year.

- The Volatility Index (VIX) has traded most of December below 14 % and this will likely result in strong flows into the equity markets in the new year.

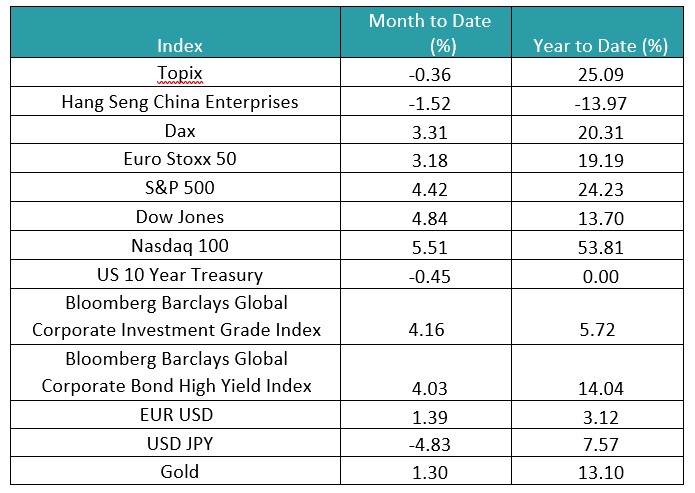

Risk assets came back strong in 2023

Equity indices had a stellar year with the tech-heavy Nasdaq 100 up greater than 50 %. Europe and Japan did well too. China still processing its re-adjustment.

Key Markets

- Asia looks well poised to continue its strong growth in 2024. With the Federal Reserve interest rate outlook moderating considerably various global Emerging Markets will stand to benefit with a relatively weaker US Dollar.

- Asia is home to 60 % of the world’s population and is expected to grow by around 11 % by 2050. A young median age means strong economic contribution as long as governments come up with supportive policies; which currently appears to be the case.

- India, Indonesia and Vietnam will lead the charge with growth in the high 4 % to mid-7 % range. Elections in India and Indonesia will need to be watched closely and barring any major surprises we would expect the growth story to continue uninterrupted.

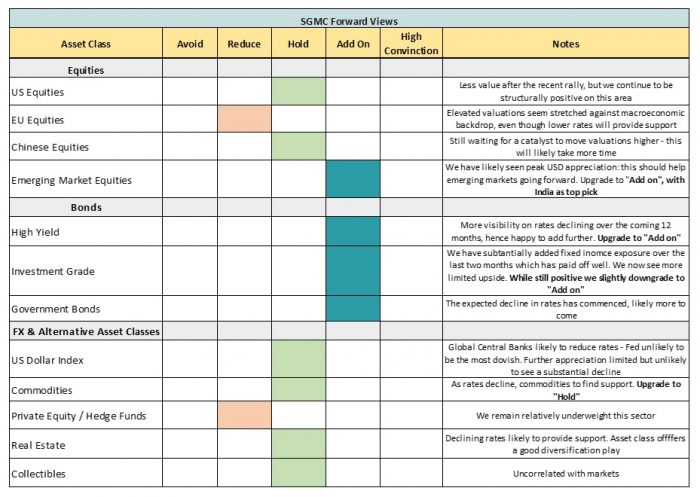

SGMC Forward Views …

- No changes to our allocations this month