MONTHLY NEWSLETTER – DECEMBER 2022

January 1, 2023 |

Download Document

A summary of key events and market trends during the month of December

- Having rallied in November asset prices were softer in December as the year was coming to a close and positions were being reduced in the low liquidity heading into the holidays.

- For the year the Dow Jones index held the best, closing the year down 9 % while the European indices lost around 12 %. The S&P 500 lost around 20 % while the technology focused Nasdaq dropped in excess of 30 %.

- While inflation has been held in check over the last few months it has still not come off appreciably enough to warrant a dovish Federal Reserve stance.

- The European Central Bank continues to signal tight policy with President Christine Lagarde closing out the year fresh with hawkish comments calling for higher policy rates.

- The Bank of Japan tweaked policy by allowing the target rate of the 10 year Japanese Government Bond to rise to 50 basis points from the earlier 25. Governor Kuroda went out of his way to term this move in policy as a means to ease market functioning and not a move to tighten.

- With China now well on a path to opening up the economy the equity markets have found a bid and the China Enterprises Index now trades some 35 % over the lows seen end October.

- The Volatility Index (VIX) continues to bump from the 20 handle, though has not moved appreciably higher despite a cooling off in asset prices towards the end of December. We await the minutes from the Fed meeting this week and this will likely set the early tone as will the end of week employment numbers.

The year draws to a close but uncertainty lingers….

The central bank reaction function to successive data prints continues to be the prime driver of global markets

Key Markets

- The Federal Reserve continues to blow hot and blow cold and while their reaction to data is likely the prime driver for now it does appear that they are keeping an eye on financial markets too.

- Dovish comments when markets head lower and a hawkish stance as investors push prices higher.

- In January 2022 the minutes released the first week set the tone for the rest of the year. Similarly, the minutes from the December meeting will be released this week and will be closely watched for content and tone.

- Earnings season kicks off next week and the health of the US economy and the consumer will be on display. Have the rapid clip of rate hikes cooled demand and taken a toll on earnings or is the economy continuing to power ahead?

- China’s moves to open the economy despite a sharp rise in reported covid cases was not thought likely just a few weeks ago. Now with international travel being opened up countries are bracing for a potential spike in cases. However, given the high level of vaccinations in most parts of the world any increase in cases is not expected to cause significant disruptions or fatalities as in the past. If the country stays the course and no further regulatory clampdowns we would expect investors to add back allocations here.

- The Dollar Index (DXY) rallied a good 20 % to its peak of around 115 last year. From there, in the last quarter, it has lost considerably and closed the year up just 8 %. A meaningful move but indicative of extended conditions at the upper end of the recent price range.

- In the final analysis Europe held up, during the latter half of the year, better than our expectations. Despite multiple challenges European banks appear to be in good health and are closed marginally positive for the year.

- We continue to like the fixed income markets and look for opportunities to build our allocations

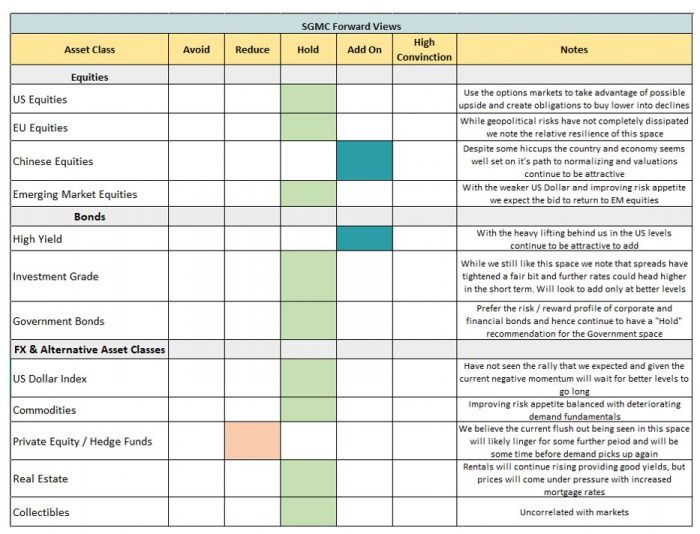

SGMC Forward Views …

- Thin markets in December as investors and traders reduce exposures and activity are usually hard to read. This year, barring China which has a long way to go to catch up with two years of underperformance, most indices lost ground as investors who added some exposure at the lows of October would have locked in gains of around 10 – 20 %.

- The Volatility Index (VIX) closed 2022 closer to the lower bound of its trading range for the year and has been a puzzle for many investors who would expect low prices and deeply negative sentiment to have warranted a significantly higher reading.

- We posit that the disruptions caused in the first six months of the year – the war in Ukraine, a very hawkish Federal Reserve, recalcitrant inflation and a locked-down China – along with the swift adjustment to asset prices meant that leverage in the system was curtailed significantly as margin calls forced the closure of extended positions. As is often the case the bid for volatility then dries up as hedging positions are then needed to a much lower extent.