Monthly Newsletter – December 2021

A summary of key events and market trends during the month of December

- Equity markets have traded broadly flat to higher after the latest Federal Reserve meeting and appear to have digested well the quicker pace of tapering

- The US two-year bond now trades at around 75 basis points which is at the highs for the year

- Over the last month however, the tone from the US Federal Reserve has taken a decidedly more hawkish turn

- Fiscal spending plans and in particular President Biden’s Build Back Better initiative will be closely followed as these will provide further impetus to the US economy

- The Volatility Index (VIX), which peaked around 35 at the start of December on concerns related to Fed policy and the omicron variant, has now settled back down to around 17

Fed Reserve communicates quicker taper…

At the last monetary policy meeting for the year Powell appeared to speed up the reduction of asset purchases.

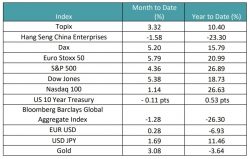

Key Markets

Recap of the year …

2020 ended on a strong note with the nascent but positive news that multiple vaccine candidates would be available in short order. The Federal Reserve, European Central Bank and other central banks had pushed the pedal to the limit to ensure that the global monetary and payment system did not collapse on itself. This led to asset prices being well supported after the initial steep correction and finished the year at or close to all-time highs.

This rally continued into the new year with all manner of risk assets putting up a strong showing in the first quarter. Digital currencies and meme stocks hogged the spotlight and in the case of the latter managed to deliver significant losses to even some well-established hedge funds.

January 2021 saw the inauguration of President Biden and with that an expectation of a change in tone and policy from the White House. The key issue to be addressed around the world was the delivery of the vaccines in as effective and speedy a manner and a coordinated and collaborative approach would likely be the best way to achieve this outcome.

Given the low base effects from the previous twelve months inflation started to rear its head and led to higher readings across both, consumer and producer prices. This led to an expectation the Federal Reserve would sooner rather than later tighten policy; expectations that, at the time, the Fed quickly dismissed on account of their opinion of inflation being “transitory” in nature and would help seed the next rally.

In the second largest economy of the world, things were to play out differently. Starting in November 2020, with the suspension of the Ant Group IPO, and what would be a thread through 2021, regulators started taking a closer look at multiple industries and businesses. In many cases they concluded with stringent measures that would put the viability of the enterprise in doubt and in others, significantly alter the future strategic path. All this was done in the name of “common prosperity”, an initiative to broad-base the gains accruing to the segments of the economy that were growing.

Along the way Chinese real estate giants started feeling the heat too; a lack of availability of funding led to significant pressure on operations and some leading names in the sector have lost anywhere from 60 – 90 % of their market capitalization. The monetary authorities have of late seen the overall impact to the sector and have made some attempt to alleviate the funding pressures.

Germany and Japan saw leadership changes; more planned and expected in Germany than Japan. Angela Merkel ended her sixteen-year tenure as Chancellor and passed the reins to Olaf Scholz of the SDP. In Japan Prime Minister Suga bowed out, in part due to the continuing COVID situation and has been replaced by Fumio Kishida. We do not expect either of these changes to bring any major immediate changes to policy.

Heading into the end of the year, inflationary pressures continued to persist and amplify; partly driven by supply chain constraints, attitudinal changes to employment as well as the lagged impact of tighter immigration policies and the continuing impact of the retiring Baby Boomer generation. All told, however, we are now likely to see the higher base effects and easing supply chain issues leading to lower price pressures going forward.

Jerome Powell flipped and flopped during the twelve months and, all told, has managed to telegraph the expectations of the front-end of policy normalization to market participants fairly well. As would be expected, his take through the year will be closely followed and analyzed.

Another year of living with the virus and the ebb and flow of travel and other restrictions has resulted in some fatigue. At the same time, the efficacy of the vaccines, the speed of their development and the news of oral antiviral treatments likely being available soon has provided a reason to be optimistic. The latest variant, omicron, created a stir initially; however, continuing assessments indicate a rapid spread in conjunction with an exceedingly mild form of illness and in most cases existing vaccines have proven highly effective.

President Biden delivered a meaningful Infrastructure Bill of around USD 1.2 trillion and also ensured passage and raising of the debt ceiling to a level that would see the US economy past the mid-term elections this year. His Build Back Better initiative is now up for discussion and, while negotiations have been protracted, we would expect this to eventually pass before the upcoming elections in November.

Volatility displayed its usual gyrations and, in general, and in line with our expectations did not create any lasting concerns. At the start of 2021 it continued to tick lower and then spent the most part of the year below the critical level of 20. The illiquid trading around the Thanksgiving holidays coupled with interest rate and COVID concerns resulted in a brief spike in the volatility index (VIX) early December; the continuing easy global liquidity position resulted in asset prices stabilizing and the VIX quickly retreated back heading into the end of the year.