MONTHLY NEWSLETTER – AUGUST 2024

September 1, 2024 |

Download Document

A summary of key events and market trends during the month of August

Global Markets Updates

- Any investor who takes a look at markets only at month-ends would not have noticed the wild gyration in prices at the start of the month.

- Investors in Japan dealing with a rate hike cycle for the first time in decades threw in the towel with the broad Nikkei and Topix indices losing around 20 % in the first three trading days of the month.

- Global markets appeared to catch the contagion, although a milder strain, with the Nasdaq down around 10 % in the same period.

- The Bank of Japan came in to placate markets by stating that they would keep in consideration the impact its policies were having on financial assets.

- Over in the United States Fed Chair, Jerome Powell, has strongly indicated that rate cuts will come through in September.

- The market is now divided on whether there is a likelihood of more than a 25 basis point cut and if there will be an almost straight-line series of cuts down to the range of around 3.25 – 3.50 % over the next 12 months.

- We note that sentiment is more muted and there is some fatigue in chasing market leaders higher despite strong earnings.

- With the US elections now only two months away and polls still fairly tight we continue to stay relatively light with allocations and look for tactical opportunities to trade given this backdrop.

- The US Dollar Index had made some gains at the start of the year but with a recently dovish Federal Reserve these have been given up. At one point the Index was up around 5 % for the year. We believe that investors who are looking to build long USD positions should use the current weakness to initiate the same.

DESPITE A NERVOUS START, A STRONG FINISH…

Multiple levers, not least the Bank of Japan’s policy normalization, led to a rocky start to the month

Key Markets

- Volatility continued to be in play this month with a large spike in the VIX at the start of the month eventually cooled in line with the Bank of Japan’s message.

- The market now prices in around 8 rate cuts of 25 basis points each over the next twelve month and the market is now somewhat divided on whether any of those will be a larger 50 basis point cut. We tend to think not, unless there is a larger and faster deterioration of economic conditions.

- This deterioration from the broader economy could creep into the equity markets and we are seeing some fatigue and muted reactions to even fairly strong corporate performances.

- Further, given the interest rate backdrop we like to take some exposure to broad market real-estate plays in order to receive good dividend yields as well as play some upside from capital appreciation.

- We have used the moves in the overall volatility markets to our advantage; selectively buying and selling options across indices and stocks to capture returns for portfolios

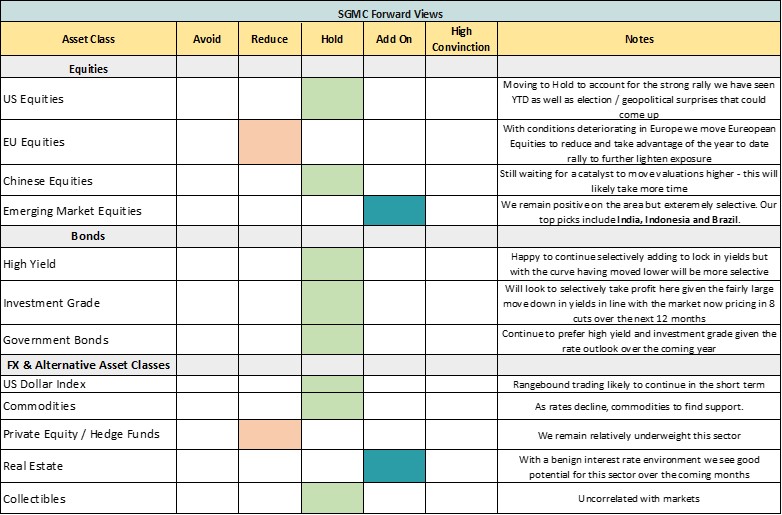

SGMC Forward Views …

- We treat volatility as an asset-class and this allows us to take an informed opinion about the same.

- The VIX in August hit a high of around 65% and is currently back to around 15% – a very wide range and indicative of the panic that ensued at the start of the month, emanating as we have mentioned from the tightening policies of the Bank of Japan.