MONTHLY NEWSLETTER – AUGUST 2023

September 1, 2023 |

Download Document

A summary of key events and market trends during the month of August

Global Markets Updates

- Global equity markets appear to be in a holding pattern – digesting the year-to-date rally and pondering the next moves from Central Bankers.

- We have for some time not expected rates to move considerably on either side of the current levels and this view has proven to be accurate.

- Markets are pricing in the mild possibility of rate hikes – only half a hike out to November 2023 – and then around 4 rate cuts, totaling 1 percentage point, out to December 2024.

- Our base case is for the slim possibility of one hike over the next few months with rate cuts coming through only when inflation or growth come off significantly from the current still elevated levels.

- With the cost of money no longer zero, stock picking for the medium- to long-term will be key to delivering portfolio out-performance.

- The Artificial Intelligence theme continues to dominate investors’ attention and separating the key players from the also rans will be an important factor for consideration.

- Earnings season is wrapping up and all sectors of the S&P 500 delivered a positive earnings surprise with Consumer Discretionary beating the most versus expectations (+ 19 %)

- The Volatility Index (VIX) continues to dwell under the pivot level of 20 and despite brief moments of frenetic activity heads to the lows since the pandemic with some ease. We look to hedge portfolios with cheap hedges given these levels.

A summer lull

The to and fro of monetary policy and central banker pronouncements keep rate market participants on their toes and have had the effect of taming some equity market bullishness.

Key Markets

- Monetary policy from the Bank of Japan continues its dovish tilt and that buoys the equity markets while pressuring the Yen lower. Policy makers are already pointing to a lower profile for inflation over the coming years and with that a stark change in stance on policy appears to be off the cards. While we do not have significant positions in the currency and only some exposure to the equity markets we look to the evolution of the situation in Japan to discern the potential impact to global markets if and when the Bank of Japan turns hawkish.

- The negative news flow from China real estate companies continues and this is not a great assist to current sentiment. The regulators are actively looking to reduce borrowing costs and ease other factors to encourage a pick-up in activity. Having said that, we have not yet hit the tipping point where the cumulative impact of all regulatory action has resulted in the spark needed to make things work in a self-sustaining manner.

- With growth in China continuing to be lackluster the spillover impact to Europe is also resultantly negative. The last reported year-on-year GDP readings for the Eurozone was a paltry 0.6 % and with rates set at 3.75 % we will likely see economies delivering meagre growth until a boost from China consumption and investment goods demand kicks in.

.

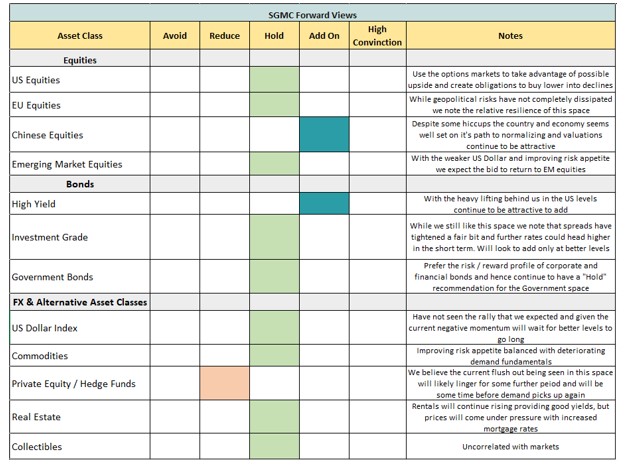

SGMC Forward Views …

- We are currently not making any changes to our forward views and asset allocation. Though, this could change as we assess the tone and content that comes through from the monetary policy meetings over the coming weeks.