Monthly Newsletter – August 2021

A summary of key events and market trends during the month of August

- US equity indices continued their strong showing

- With only some 10 % of the S&P 500 companies left to report earnings for the quarter the numbers look unambiguously strong; and across sectors.

- Fed Chair Powell’s speech at the Jackson Hole Economic Symposium indicated a Fed that continued to look for reasons to not initiate monetary tightening while also acknowledging that they would need to act relatively soon

- The Volatility Index (VIX) continued its time below the 20 level as risk assets find a strong bid

Substantial further progress…

Yes, but we’re not there yet

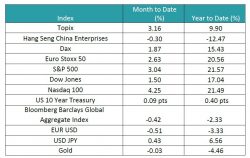

Key Markets

Recap of the month …

Fed Chair Jerome Powell, at his speech at the Jackson Hole Economic Symposium, acknowledged that while the US economy had made substantial further progress towards meeting its inflation goals, the country had yet to put back to work the millions of individuals who had lost their source of livelihood during the initial days of the pandemic in 2020.

As such, while we are now closer to when the Fed will likely start the process of tapering its security purchases we don’t appear to be there, yet.

As an aside, and to recapitulate, the size of the monthly purchases is large, USD 80 billion worth of US Treasuries and USD 40 billion of Mortgage Backed Securities. This buying program was instituted during the worst days of the pandemic when the deepest and most liquid securities market in the world, the market for US Government Bonds, effectively froze. In turn this disruption was the result of the dollar shortage faced by corporates and governments around the world as supply chains ground to a halt. Now, as economies and societies are on the mend, the need for such a program of support is debatable.

While financial markets enjoy surplus liquidity, they, equally, dislike these funds being withdrawn. With the Fed nearing the time when it will reduce its purchases, will we likely see a dollar shortage with a resultant spike in rates ?

Part of the answer to this question lies in the answer to two additional, and critical, questions:

- What is the likely future path of borrowings by the US Government ?

- What is the likely future path of US Treasury purchases by international investors; primarily sovereigns ?

A smaller borrowing footprint by the US Government and continued, possibly increased, support for US Treasury paper by large sovereign investors will see markets clear in an orderly manner. We will be monitoring the progress of these developments closely.

In China, regulatory pronouncements continue apace. And while this effectively redefines the playing field we are now seeing equity prices less sensitive to the headlines. Could it be that after significant absolute and relative underperformance the Chinese equity markets have adequately priced in the worst-case ?

Our answer to this question is in the affirmative and we see good value in many of the leading, well-established names and have been building exposures to the same.

Over the month the US Dollar flat-lined, again. However, with the upcoming Non-Farm Payroll report this Friday, the European Central Bank meeting next Thursday and the Federal Reserve holding its next monetary policy meeting towards the end of the month we would expect some directional moves to build up into the end of the year.

Volatility continues to be subdued across most asset classes, and how well the Federal Reserve handles the reduction of the pace of its balance sheet growth will dictate if this stays the case.