MONTHLY NEWSLETTER – APRIL 2025

May 1, 2025 |

Download Document

A summary of key events and market trends during the month of April

Global Markets Updates

- The far reaching and heavy US tariffs imposed, with China being the large outlier, created an initial shock to the global economic system and as a result to all areas of global markets.

- The initial market impulse had been to reduce exposures and this led to a cascade of selling in the equity, bond and currency markets. There have been multiple credible reports of large hedge funds imploding with the resultant volatility and this added to the negative sentiment.

- There is a considerable amount of work left to be done; first to understand the point at which trade policy stabilizes and then for global supply chains to reorient to the new reality. While the Trump Administration has spoken of multiple negotiations in progress there is scant detail, if any, available on final terms.

- As a result, we expect a material slowdown in growth in the coming months. The question now is if the valuation of assets at the previous recent lows adequately discount the negative sentiment and reality.

- Quarterly earnings data from US Banks were off the charts on account of the strong trading volumes put through in the recent panicked selling. Coming quarters will tell the story of how well they continue to weather the trend.

- The technology sector has also had a good showing with Netflix, Alphabet, Meta and Microsoft among others delivering strong results.

- We will closely monitor the health of not just the currently incoming data but also prospective releases and tariff announcements to understand the best portfolio positioning.

- We have used the spikes in implied volatility to our advantage by selling at elevated levels and creating strong entry points to our preferred assets.

TARIFFS UPEND ECONOMICS & MARKETS

As much as markets were braced for a negative follow through from the tariff announcements and further escalation they were not braced enough.

Key Markets

- Overall the deep initial equity market correction of the first half of April has been mostly offset by the rally in the second half of the month, with most equity indices managing to close the month not too far from where they started it

- One data point that clearly stands out is the strong depreciation of the US Dollar since the beginning of the year, weighed down by tariff and economic insecurity as well as an overall lack of confidence. The Greenback has already lost close to 10% against the EUR this year, and we believe this trend could continue, even though at a relatively lower pace

- European stocks continue their strong relative year when compared to their American counterparts, as the performance differential between Eurostoxx and S&P is of over 10% in favor of European names, even though in absolute terms American names fared better in April, but only by a small margin

- Gold remains one of the main beneficiary of geopolitical tensions and economic noise, raising over 25% year to date and having touched its historical all time high this month of 3,500 against the Dollar

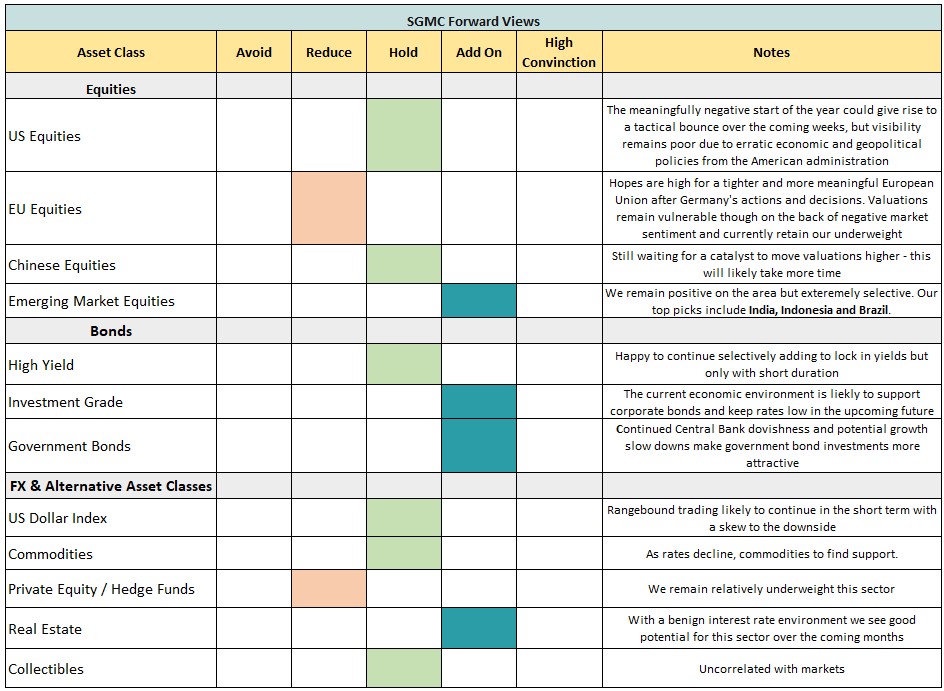

SGMC Forward Views …

- No changes to views this month