MONTHLY NEWSLETTER – APRIL 2024

May 1, 2024 |

Download Document

A summary of key events and market trends during the month of April

Global Markets Updates

- Global equity markets were soft during the month with a series of events that had to be contended with; hostile geopolitics, sticky inflation and still strong growth which pushes US Federal Reserves rate cuts further out

- Along the way the immediate and short-term expectations of investors have tended to be, on balance, slightly more bullish than what companies are able to deliver. Not that growth is falling off a cliff; it isn’t – we more have a scenario where some of the companies leading the rally are trimming investors expectations a tad

- China bucked the trend again and delivered strong numbers as investors chose to focus on marginally better data and took advantage of funds exiting markets which had already run up significantly over the year.

- US Federal Reserve Chair, Jerome Powell, last Wednesday pushed back on expectations of a rate hike and while that is a good sign for investors we still have some residual selling coming through from investors reevaluating their positions

- The Bank of Japan is keeping currency traders on their toes by reportedly intervening in the FX markets. After raising rates they are still on the extreme dovish end of the spectrum; year-end rates are closer to only 0.30 %. Investors preferring to take advantage of the positive carry from short JPY positions are, in effect, calling out the BoJ on its policy choices. We have little exposure to the JPY; however, we monitor developments closely to ensure that currency volatility doesn’t spill over to other asset classes.

- The Volatility Index (VIX) was volatile this month with a quick (day-long) peek over the important pivot level of 20. It has now subsided and is back down to a 15 handle indicating a quieter immediate outlook.

And then there was one ….

Strong growth and recalcitrant inflation have now pushed US rate expectations to just one cut by the end of the year.

Key Markets

- India heads to the elections with results expected early June. We expect Prime Minister Narendra Modi to win another term and a strong showing for the Bharatiya Janata Party. This appears to be well anticipated outcome and, as such, parsing the details of the victory will be important in understanding the nearer term trajectory of the markets and of the Indian Rupee. We continue to be optimistic about the long-term direction of the economy and would be ready to buy any dip that may emerge.

- The Bank of Japan has painted itself into a corner. It wishes to prevent its currency from depreciating against the US Dollar while holding rate differentials at extremely wide levels. At the current time, buying US Dollars for a year while funding that purchase with Japanese Yen pays an investor around 5 %. Levered currency investors seek out such differentials to go long the higher yielding currency (USD) while shorting the lower yielding one (JPY) which puts downward pressure on the JPY.

- The BoJ could choose to close the gap by hiking rates aggressively; this, however, would derail the equity markets as well as the fixed income markets. Further, the Japanese Government over a long period of time has borrowed significant amounts of money and the BoJ has purchased this debt by Quantitative Easing. The cost of this debt rises in direct proportion with any rate increase.

- So, while not wishing to raise rates aggressively the Bank of Japan and the Japanese Ministry of Finance would like investors to not take advantage of yield differentials that are available. To that extent they are willing to sell their US Dollar Reserves (of which they have more than a trillion) to buy Japanese Yen and support the currency.

- Global currency investors enjoy taking on central banks with an untenable position. Time will tell which way this resolves and as mentioned earlier we have negligible exposure to the JPY. In the interim, it will be riveting to watch the constant to and fro between the Bank of Japan and the George Soros’ of today.

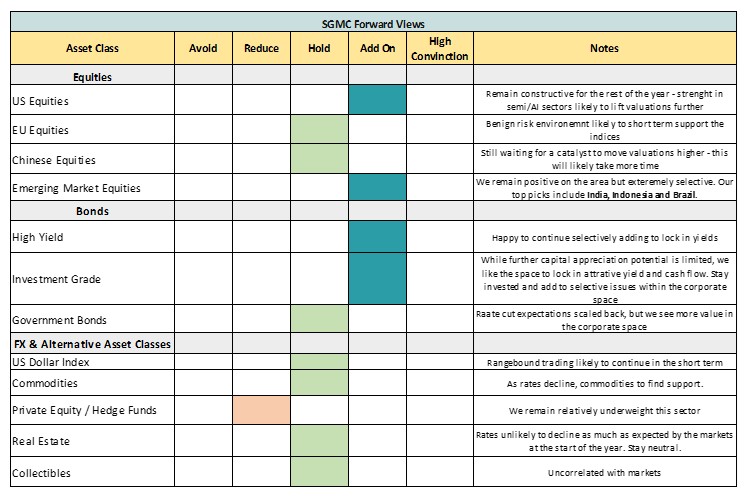

SGMC Forward Views …

- We have not made any major changes in our forward views as compared to last month

- Overall, we believe the constructive environment in global equities will continue over the coming months