February Monthly Review

A summary of key events and market trends during the month of February.

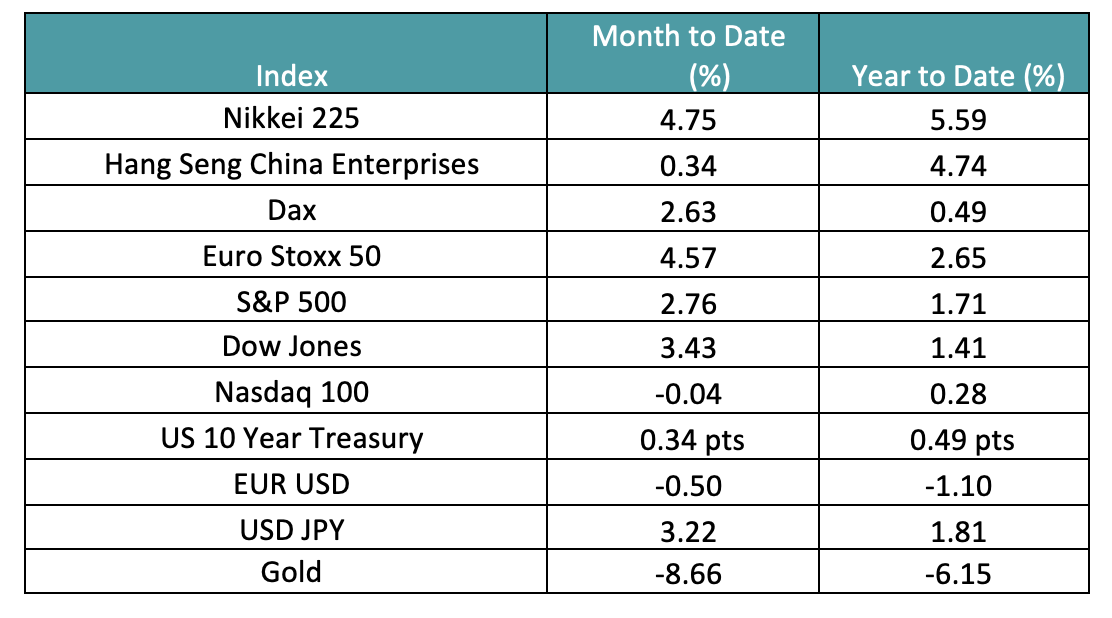

Another month passes with equity indices treading water. US 10 year yields were higher by 30 bps at month end; with an intra-month high of 55 bps at 1.60 %.

With the Volatility Index (VIX) resolutely over 20 and, on occasion, spiking easily over 30 we increase our watchfulness over short term events.

Based on this backdrop we have initiated / look to initiate hedges to equity positions.

Bond yields limiting risk assets

Rising commodity prices rising inflation concerns and rising yields put the next Federal Reserve Monetary Policy meeting on 17th March in focus.

Key Markets

Recap of the month …

We are now two months into the year and developed market equity indices are trading flat while Asia has delivered stronger performance, while currently off the highs seen in February.

The bulk of S&P 500 companies have reported results for the quarter and have delivered a marginal positive surprise on sales (3 %) while delivering a strong positive surprise on earnings (17 %). Steady as she goes.

The interest rate markets are, however, where all the action and, increasingly, where the focus is. US fiscal stimulus expectations continue to be strong and for a variety of causes; pandemic relief, infrastructure, student debt relief and alternative energy, to name a few. This isn’t a surprise to us and has been a factor that has been front and center for us for some time. The market too has finally woken up and is now taking notice.

Copper is up some 16 % for the year while iron ore prices increased around 14 %; crude oil is also up approximately 26 %. None of these prints augur well for inflation and Fed Chair Powell has gone on record, again, to state that inflation is not a problem and that the key focus is on ramping up job growth. Weekly jobless claims continue to be stubbornly high and these conflicting realities likely force the Federal Reserve to perform a delicate balancing act in an environment of stretched equity valuations.

The Federal Reserve’s communication of policy on 17th March will be keenly watched and we would likely look to reduce equity risk exposures heading into the event.

The US dollar too has been a beneficiary of rising rates and the Dollar Index (DXY) is higher this year by about 1 %. While this does not appear to be a big move, it should be noted that it is against a backdrop where a number of market participants, us included, have been calling for a much lower price for the US dollar.

Gold appears to have lost favor in the current environment and one possible explanation doing the rounds is that flows into the anti-fiat trades appear now to be head to Bitcoin and other blockchain related avenues.

Bitcoin continues to be a volatile asset and experienced another 20 % drop in price over a period of a few days towards the end of the month. Having said that, blockchain technology continues to develop apace with decentralized finance (DeFi) applications being released with a steady cadence. Use cases are expanding to mobile chat, secure file storage, travel apps and video gaming to name a few. We continue to follow developments in this space closely.

In summary, the longer-term picture continues to see US monetary and fiscal policy supporting the macro environment and equity markets and to pressuring the dollar lower as well as containing volatility. However, in the short term we expect rising pressure from the bond bears and a tricky communication challenge for the Fed to be bigger drivers of asset returns.