MONTHLY NEWSLETTER – JANUARY 2025

February 1, 2025 |

Download Document

A summary of key events and market trends during the month of January

Global Markets Updates

- The U.S. kicked off 2025 with significant changes as Trump returned to office, reshaping trade policy. No time was wasted in announcing a 10% tariff on Chinese imports starting February 1st. Despite these trade tensions, the American economy shows remarkable resilience, with strong productivity gains and robust business confidence

- Europe is charting its own course, with the ECB implementing its fifth consecutive rate cut since mid-2024, bringing rates down to 2.75%. Interestingly, European manufacturers appear more worried about Chinese competition than U.S. tariffs.

- China’s economic challenges are mounting as Beijing grapples with growing fears of a debt deflation trap. The situation is further complicated by Trump’s renewed trade pressure, particularly the latest tariff announcement. Despite Beijing’s increasingly proactive economic policies, maintaining growth momentum has proved challenging in this environment.

- Meanwhile, Japan stands out as a bright spot in the global economy, with the Bank of Japan signaling continued rate hikes amid rising wages and prices. The economy is performing above its potential rate, benefiting from a virtuous cycle between wage growth and price increases. However, regional tensions remain a key focus, with Tokyo working to maintain crucial U.S. security commitments.

- The global economic landscape is increasingly being shaped by U.S.-China tensions, with other major economies carefully positioning themselves in response. Europe’s diplomatic pivot toward the U.S., Japan’s economic resilience, and China’s mounting challenges suggest we’re entering a period of significant realignment in global economic relationships.

EARNINGS IN FOCUS

Continuing strong results from Corporate America, especially Banks and Financial Institutions and from large cap Tech provide support to the broader indices

Key Markets

Recent developments in the world of AI

- In January 2025, Chinese AI company DeepSeek made waves with two new releases – their DeepSeek-V3 on January 10th, followed by their R1 model focused on reasoning capabilities on January 20th. The R1 model caught attention by matching OpenAI’s o1 model performance at a “reported” training cost of just $6 million, significantly less than typical U.S. development costs.

- The story took an unexpected turn when Jeffrey Emanuel, a Brooklyn-based blogger with backgrounds in computer science and investment analysis, published a detailed 12,000-word analysis suggesting investors should short Nvidia stock. it gained significant attention after some noted venture capitalists shared it on their social media accounts.

- The market response was significant. Nvidia’s stock dropped 17% when trading opened on January 27th, reducing the company’s market value by nearly $600 billion – setting a record for the largest single-day decline of any U.S. company. The decline affected the broader tech sector, with the Nasdaq falling more than 3% as investors reconsidered AI company valuations.

- Industry leaders offered measured responses. OpenAI’s Sam Altman called DeepSeek R1 “impressive” while noting that OpenAI would develop more advanced models. Nvidia acknowledged the achievement while highlighting the continued importance of their GPUs for AI applications. The tech community had mixed reactions with some comparing these developments to the space race and others questioning the veracity of DeepSeek’s claims.

- These events sparked discussions about AI development costs, America’s tech leadership position, and the sustainability of current AI business practices.

- We continue to be optimistic on the longer-term potential of Artificial Intelligence as a them and will look to add exposure on declines.

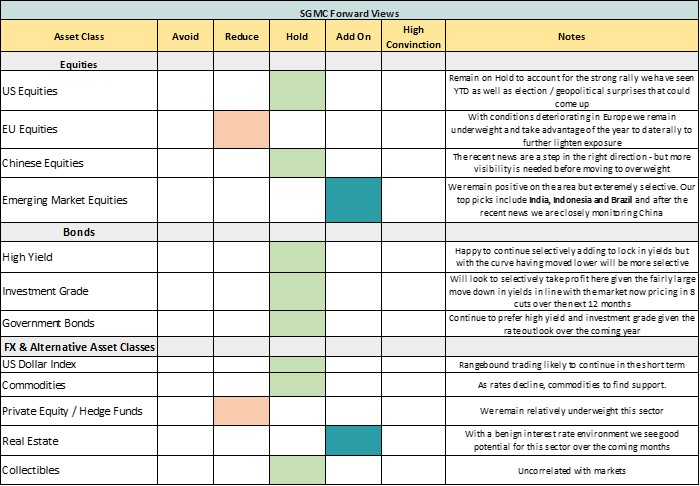

SGMC Forward Views …

- No changes to current allocations